Bramshill Investments Team

Recent Posts

2018 July Portfolio Commentary

BRAMSHILL BLOG: From the Desk of Art DeGaetano The Bramshill Income Performance Strategy returned +0.46% net in July, contributing to a +2.72% YTD total return. In July, interest rate volatility ...

Read MoreTrump vs. Powell

One major battle we are watching closely in the second half of 2018 is the epic tug of war playing out between the economic forces of the competing actions taken by President Donald Trump and Federal ...

Read More2018 June Portfolio Commentary

BRAMSHILL BLOG: From the Desk of Art DeGaetano The Bramshill Income Performance Strategy produced a positive total return of +0.44% for the month putting our YTD returns at +2.29%. June proved to be ...

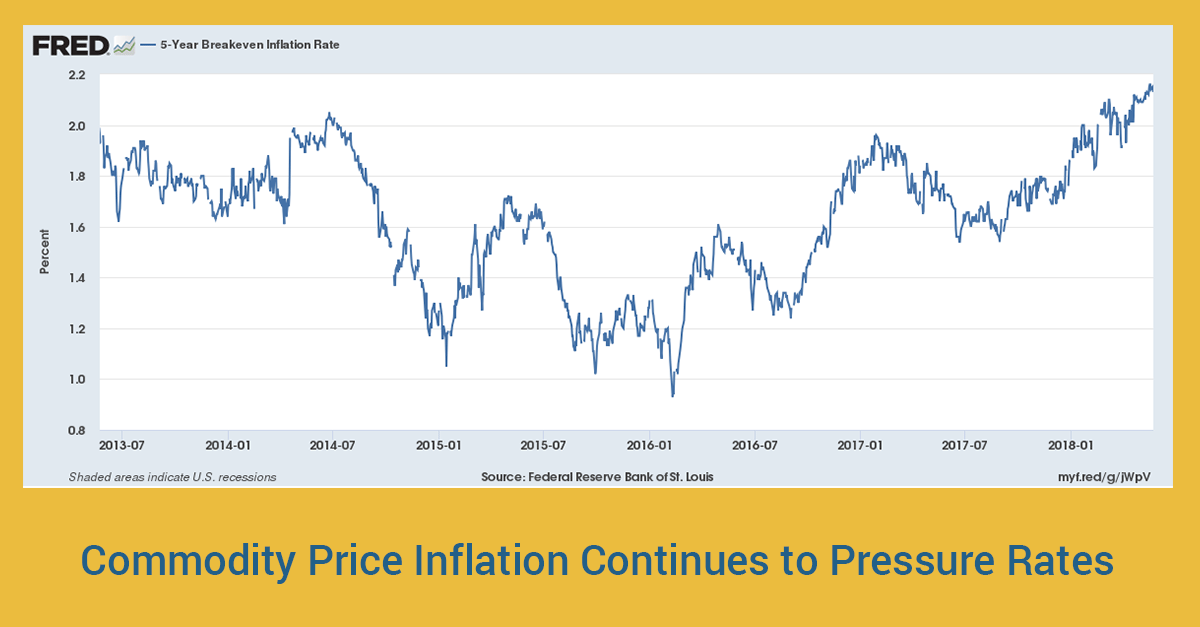

Read MoreHow will Interest Rates React to Commodity Price Inflation?

If commodity price inflation continues, how will interest rates react? We have been debating this question internally for a while now as it has meaningful consequences across asset classes. For fixed ...

Read MoreThe End of TINA

Remember “TINA,” that catchy acronym standing for “there is no alternative?” It was constantly being used to justify why equities were the only logical destination for your investment dollars. After ...

Read MoreGrant's Interest Rate Observer

Grant's Interest Rate Observer interviewed Bramshill on March 9, 2018. The full article is below or you may click here to view as a PDF. While you wait Something beyond the grudging yield on Warren ...

Read MoreWhat if Bonds are NOT the Negatively Correlated Asset?

Let’s play out a “What If” scenario. What if, during the next major equity bear market, bonds (and their brethren, bond funds) are NOT the negatively correlated assets that they have typically been ...

Read MoreOur 3 Most Popular Blog Posts from 2017

Happy New Year! We sincerely appreciate you for reading our thoughts on the market. We hope this information has been useful. Below, we have highlighted our top 3 most popular blog posts from 2017. ...

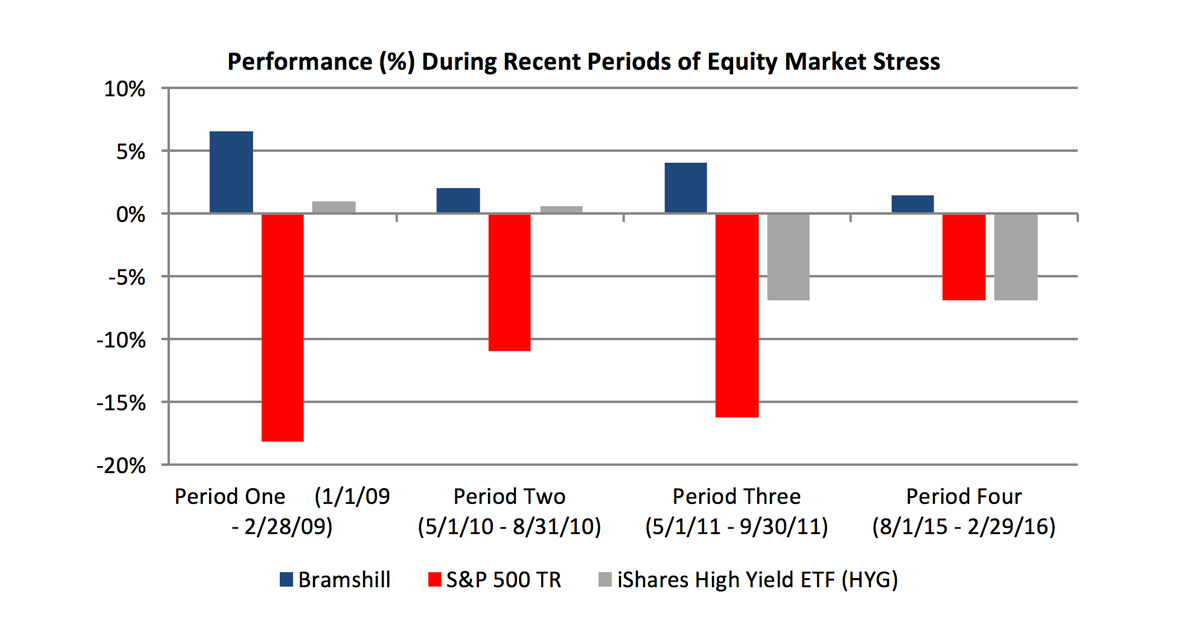

Read MoreDoes Your Tactical Bond Manager Avoid Equity Market Drawdowns?

WHY NOT ALL TACTICAL BOND MANAGERS ARE CREATED EQUAL. The more conversations we have with fixed income investors, the more we keep realizing how different we are from the crowd. While the intricacies ...

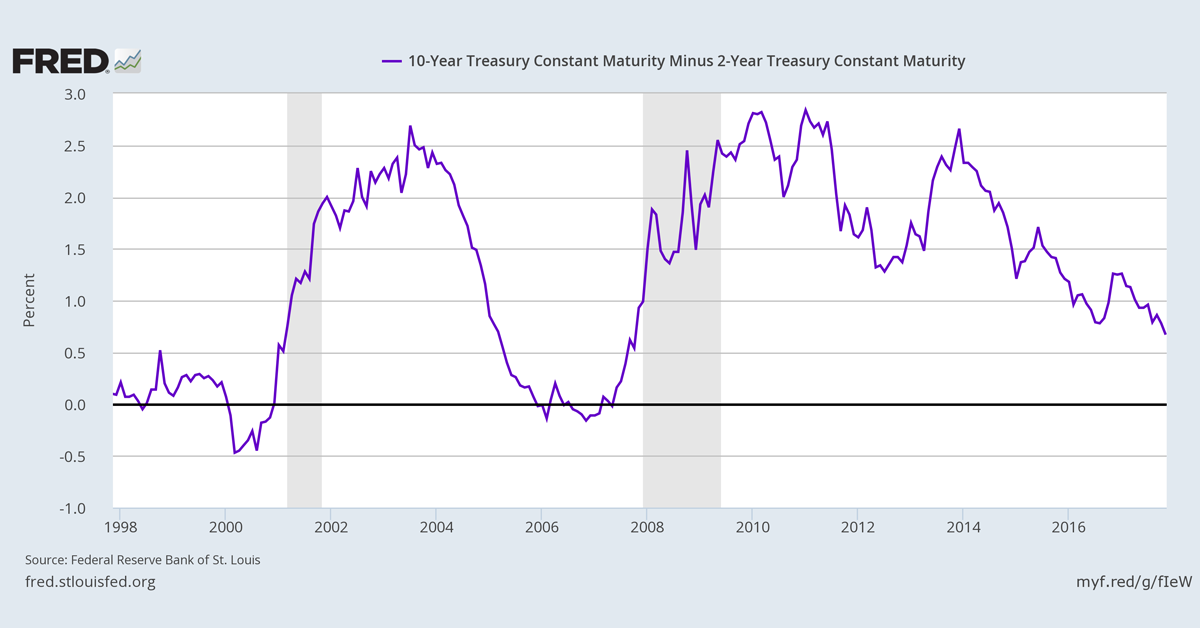

Read MoreFlattening Yield Curve: Recession Signal or False Flag? Why We’re Watching Financials

Some market participants have expressed concern about the flattening yield curve. They have noticed the flattening occurring in the U.S. Treasury yield curve and have proclaimed that a recession is ...

Read More