Bramshill Investments Team

Recent Posts

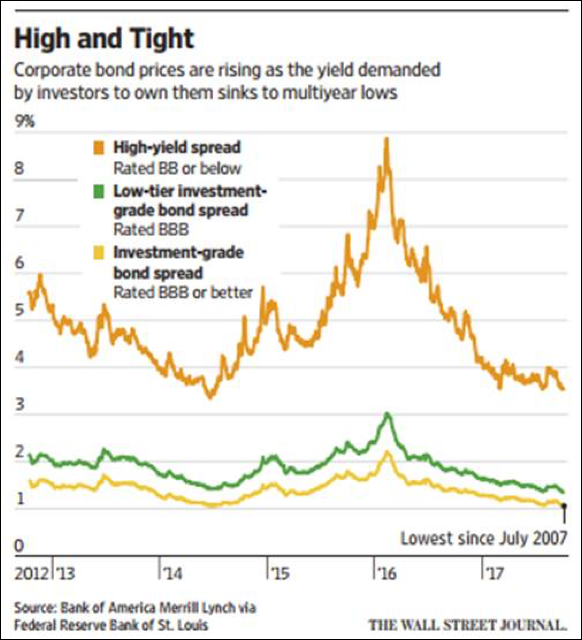

How Tight Credit Spreads Could Result in Higher Correlations and Increased Drawdown Risk

Fixed income investors who have made significant allocations to investment grade corporate bonds, municipal bonds, and high yield corporate debt may be surprised by negative total returns when ...

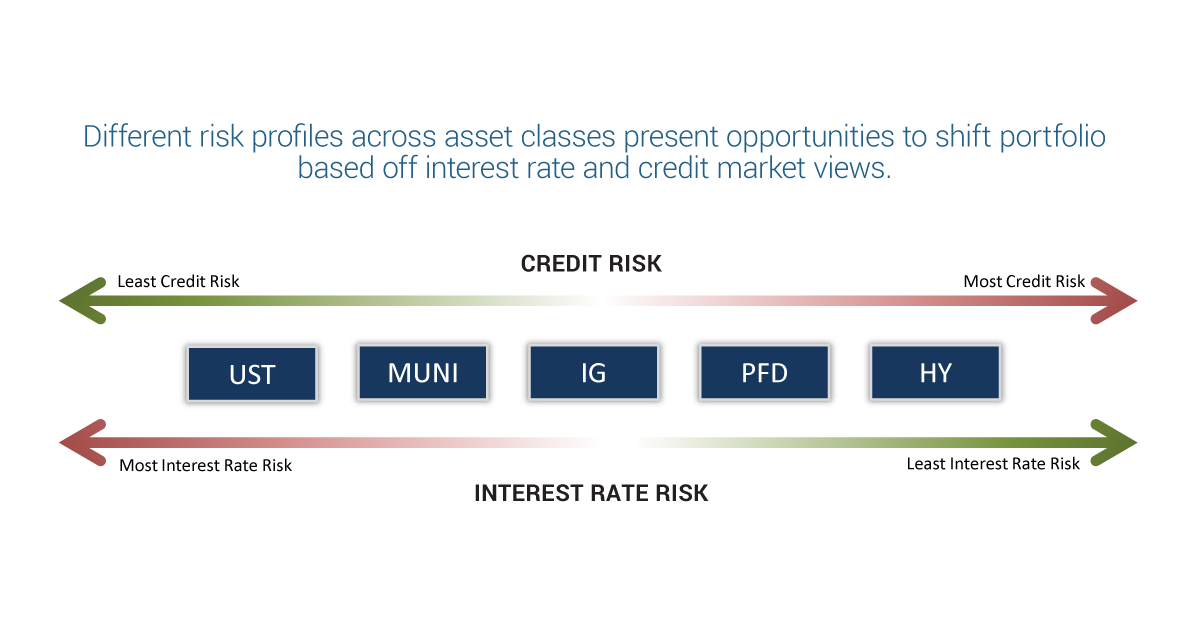

Read MoreFixed Income Asset Class Review

In preparation for our quarterly webinars with RIAs, family offices, and institutional investors, the team at Bramshill pulls together interesting market charts, macroeconomic statistics, and micro ...

Read MoreFixed Income Sector Flows During Q3 – Interesting Revelations and Few Surprises

We love analyzing sector flows within the bond market. It removes the noise of the talking heads and reveals how investors are actually allocating their fixed income portfolios. Below we review the ...

Read More