US Preferred Securities: Unique Characteristics from a Bramshill Perspective

With interest rates around the world at or approaching all time lows, income investors have an obvious motivation to look beyond their customary areas of market concentration. From its perspective as ...

Read MoreTrump Vs. Powell Update, Round 4, Trump TKO?

“Its OK Jerome, you can go back to your corner now… Thanks” We have been opining for a while now on the battleground between these two market movers. In Round 1 back in July of 2018, we felt the ...

Read MoreTrump Vs. Powell Update, Round 3

A few months back we updated you on a major battle we felt was going to heat up in the second half of 2018. In Round 1, back in July, we felt the battle between the market forces of the two men’s ...

Read MoreTrump Vs. Powell Update, Round 2

A few months back we mentioned a major battle we felt was going to heat up in the back half of 2018. You can click here if you missed it. In sum, we felt the battle between the market forces of the ...

Read MoreQ&A with Bramshill Investments: Addressing Liquidity Concerns

On our last Bramshill Investments quarterly conference call, a couple of our investors asked the following questions: Q1: Are there any liquidity concerns across fixed income today given that dealer ...

Read MoreTrump vs. Powell

One major battle we are watching closely in the second half of 2018 is the epic tug of war playing out between the economic forces of the competing actions taken by President Donald Trump and Federal ...

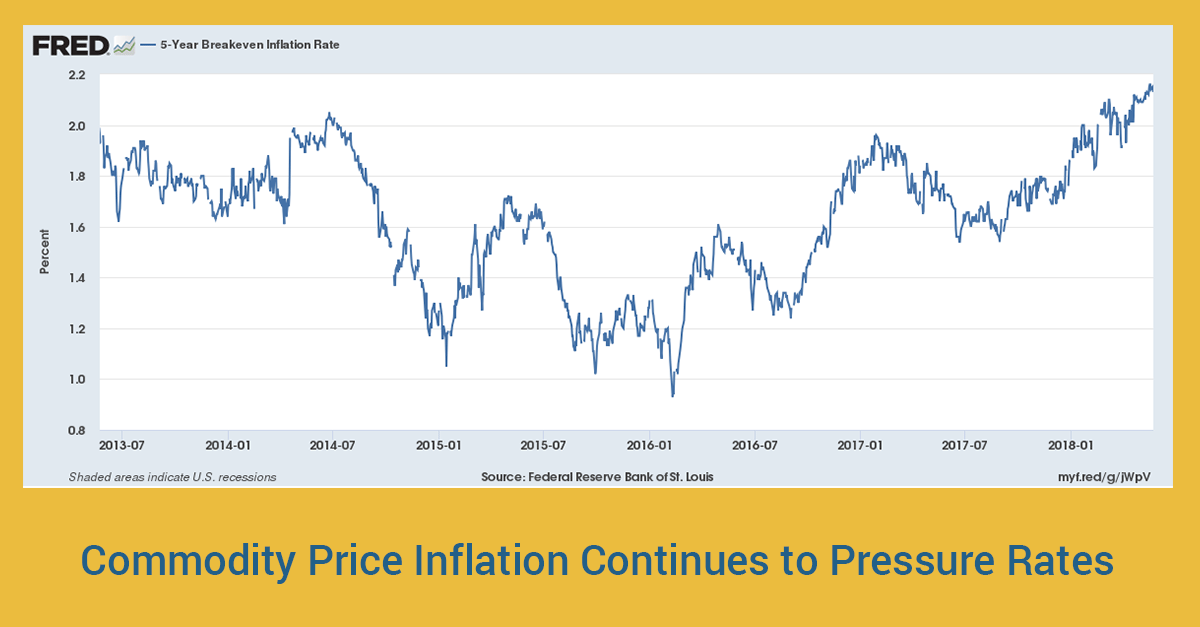

Read MoreHow will Interest Rates React to Commodity Price Inflation?

If commodity price inflation continues, how will interest rates react? We have been debating this question internally for a while now as it has meaningful consequences across asset classes. For fixed ...

Read MoreThe End of TINA

Remember “TINA,” that catchy acronym standing for “there is no alternative?” It was constantly being used to justify why equities were the only logical destination for your investment dollars. After ...

Read MoreWhat if Bonds are NOT the Negatively Correlated Asset?

Let’s play out a “What If” scenario. What if, during the next major equity bear market, bonds (and their brethren, bond funds) are NOT the negatively correlated assets that they have typically been ...

Read MoreIs the “Great Rotation” Upon Us? RIAs Reassess Risk in Fixed Income

The “Great Rotation” debate appears to be back. The term was originally coined by Bank of America Merrill Lynch (BAML) in 2011 and was used to describe the massive impending asset class shift of ...

Read More