Remember “TINA,” that catchy acronym standing for “there is no alternative?” It was constantly being used to justify why equities were the only logical destination for your investment dollars. After all, with interest rates at 0% and fixed income yielding practically nothing, equities were the only asset class generating any sort of respectable yield and total return. Well, TINA might be dead. With the Fed raising rates and LIBOR up fairly dramatically, short-term bonds are now yielding close to 2% or better. The perception of cash appears to be changing and the implications for risk assets could be massive.

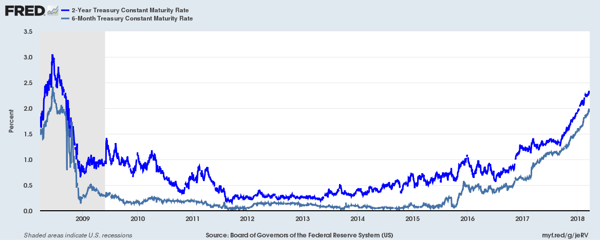

The chart below shows the historical yields of the 6-Month Treasury and the 2-Year Treasury over the last 10 years. As we can see, from roughly 2012 through 2015, yields were basically 0% for the 6-Month and 0.25% - 0.50% for the 2-Year. It is easy to see the past attraction of TINA given this situation.

However, today’s environment is quite different. With yields now hovering around 2% and the downside quite limited, the risk-reward of these short-term bonds is once again compelling. For starters, real yields on short-term bonds are now positive. With headline CPI around 2.2% and the headline PCE deflator about 1.7%, real yields at the short-end are approaching 50 bps or so. While not mind blowing, they are at least generating a positive real yield, carry little drawdown risk and offer attractive diversification benefits. At the very least, you can sleep well at night.

For risk assets, the cash allocation alternative will continue to present challenges. Consider the following:

- The TINA narrative pushed many investors into dividend-paying equities as a way of generating yield that their bond portfolio was lacking. With the current dividend yield on the S&P 500 at 1.95% (as of 3/22/18), it no longer makes sense to take on equity risk for the same yield being offered on the risk-free Treasury. Consider six-month Treasury bills yield more than S&P 500 dividends for first time since 2008. Sure, you might get the upside participation of stocks, but if your main motivation was yield-generation via bond-proxy, this solution is a high risk one. In our view, dividend equities are no longer as attractive as they were when rates were at 0%.

- Sticking with equities, if interest rates are rising, then the risk-free rate is also rising. Since the risk-free rate drives the discount rate that most analysts use to value stocks, then a rising discount rate makes equities appear more expensive. More expensive equities should lead investors to desire greater diversification in an attempt to mitigate the potential drawdown risk.

- Moving to bonds, as the Fed proceeds along its rate-hiking path and as the U.S. Treasury increases issuance, this combination should lead to rising short-term yields. As interest rates continue to rise, many fixed income securities will experience principal loss thereby making cash an even more attractive asset class. With less rate risk and a relatively attractive yield, short-term bonds look good on a risk-reward basis.

- For the riskier sectors of the bond market, the TINA narrative was similar. Investors chased yield wherever they could find it. Risk was essentially disregarded as yield-generation was paramount. Well, with rates rising, it is likely that a repricing of these securities will be needed. For example, consider high yield corporates. They were relatively decent at a yield of 5-7%. However, with LIBOR rising and cash now at 2%, an investor should probably require an 7-9% yield in exchange for the risk. The only way to get there is to reprice and that will be painful. We expect this general repricing of debt for speculative-grade companies will substantially increase credit risk.

The risk-free rate sets the baseline for all asset classes. With short-term interest rates rising, the perception of cash as an asset class has now changed. Positive real yields and limited downside risk make cash-like securities an attractive alternative to TINA and other risky yield-generating strategies. Bramshill is well positioned for a repricing of speculative-grade debt. Upon such a repricing, there will likely be extensive opportunities amid such volatility in the months ahead.

As always, please reach out to the Bramshill team if you would like to discuss this further.

Past performance may not be indicative of future results, which may be impacted by unforeseen economic events or evolving market conditions. The indices quoted are included for illustrative purposes only, as an index is not a security in which an investment can me made. Certain statements are forward-looking and may not come to pass.