With interest rates around the world at or approaching all time lows, income investors have an obvious motivation to look beyond their customary areas of market concentration. From its perspective as an unconstrained income investor, Bramshill believes that the U.S. market in preferred securities is quite compelling compared to most alternatives.

Preferred securities have greatly evolved in recent years. From their early origins in this country as a vehicle used primarily to finance growth in utilities, they evolved beginning in the 1980’s to be used primarily by financial firms that found them to be a useful tool for building a capital structure that met their regulatory environment, although they continued to be used by utilities, industrials, REIT’s, and other sectors of the economy. Traditional preferreds were originally conceived as an intermediate form of capital that occupied a position in the capital structure between common stock and debt and received a fixed payment from after tax profits, which could be interrupted only if dividends to common shares were discontinued (but without forcing a default as would be the case for an interruption in debt service). Because dividends on many of these securities are paid from after tax profits, both individuals and certain corporate owners may be allowed to deduct 70% of the income from their income tax, the “Dividend Received Deduction” or DRD.

More recently, a variety of newer structures have been offered which are more nearly like debt than the traditional preferred shares, though they usually are exchange listed and trade in a manner similar to traditional preferreds. These include securities characterized as senior notes, which are effectively bonds; trust and hybrid preferreds, which combine debt and equity; and REIT preferreds for which interest payments are paid from after tax profits but do not receive the DRD privilege due to other tax benefits available to REIT’s. Non-US firms sometimes offer preferred securities denominated in dollars, which are referred to as Yankee preferreds. The total dollar based preferred market is estimated to be approximately $500 billion, and is broken down by type and issuer as shown in Figure 1.

Although this level of preferred market capitalization makes the sector eminently investable, its modest size relative to $ 4 trillion of US corporate bonds and $ 26 trillion of US equities helps explain why it is sometimes overlooked by income investors.

Risk, Return, and Correlation

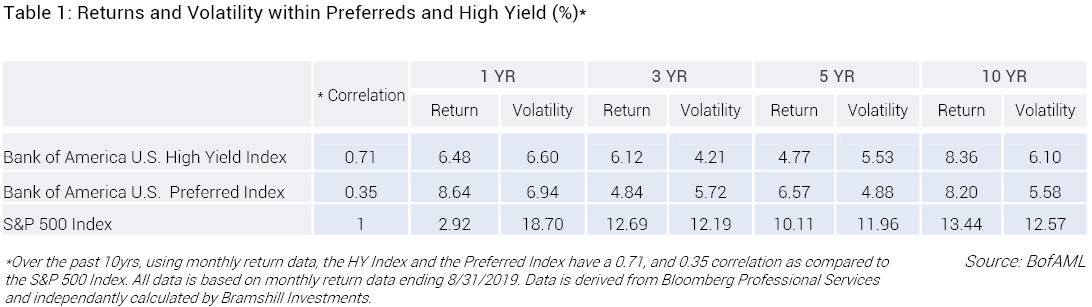

Discussion of returns and risk in this sector needs to be undertaken in the context of the global financial crisis of 2007-9. Prior to the crisis, preferreds had an annualized return of approximately, 7.9%. This was better than the 10-year Treasury and less volatile. However, prices fell sharply from late 2007 through early 2009 before rebounding sharply after the financial sector was recapitalized under TARP. As Table 1 illustrates, for the past ten years, the annualized total return for the sector measured by the Bank of America Preferred Index was 8.20%. This is very comparable to the 8.36% annualized total return for U.S. high yield. Table 1 below reports annualized volatility for periods within this history, showing that since the financial crisis, contemporary preferreds have been less volatile than equities. More significantly, the correlation of preferreds (0.35) to equities is far less than high yield (0.71). This indicates that the diversification benefit of preferreds within a fixed income allocation is much greater than high yield with a comparable return and less volatility.

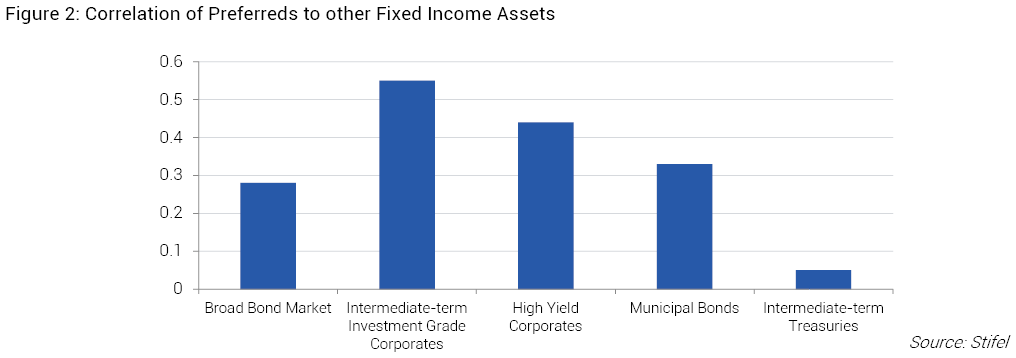

Additionally, correlations with other fixed income asset classes, shown in Figure 2 below, suggest that preferreds offer interesting opportunities for portfolio diversification. Even though this data includes the period during the global financial crisis, these correlations indicate that preferreds offer considerable diversification relative to other components of the bond market. Indeed, from these statistics preferreds would appear to act more like investment grade corporates than either government bonds or high yield.

Another perspective on the risk (or lack thereof) in this sector is the improved financial quality of the issuers and default risk. In general, the ratings agencies treat preferreds as a form of debt in their ratings and usually rate preferreds two or three levels below senior debt securities. However, because the majority of issuers of preferreds are themselves investment grade, most preferreds carry investment grade ratings from the agencies. This fact, along with the fact that default rates are lower than high yield debt, confirm that preferreds are usually of higher credit quality than high yield debt, despite the fact that the asset class originated as a form of “stock”.

Recent trading episodes serve to confirm the rating agencies’ evaluation of the improved credit quality of these securities. Of the nine largest quarterly moves up or down by preferreds since 2012, two thirds were consistent with the direction of investment grade corporate bonds. Additionally, the attraction of this sector relative to equities and high yield credit were illustrated somewhat dramatically in the recent 2015-6 drawdown. In January 2016, for example, equities declined by over 7%, high yield by over 3%, while preferreds were little changed that month.

Preferreds in the Financial Sector

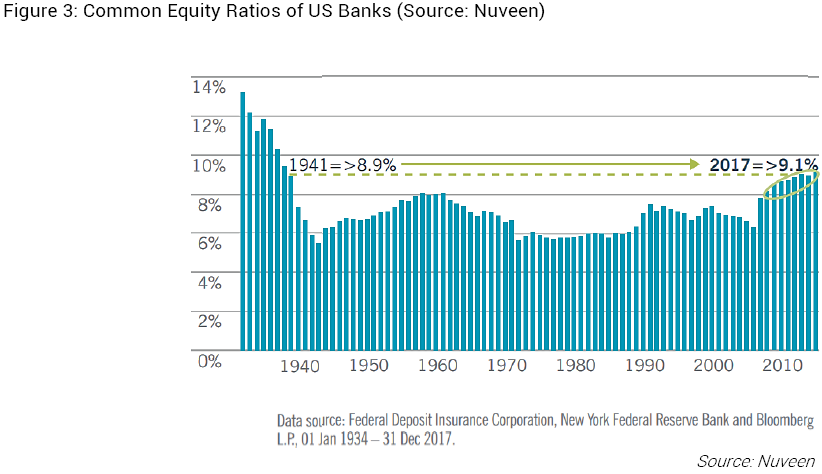

A further commentary on the current quality of preferred securities is provided in Figure 3 below, which shows the increase in common equity of banks (the largest single issuer of preferreds) since the global financial crisis. In this period, banks have increased their capital through issuing securities, retaining earnings, and limiting leverage, with the objective of achieving a much more stable financial structure than existed before 2008,

Closely related to the matter of increased capital on bank balance sheets is the US banking system’s major re-regulation under the Dodd-Frank banking reforms, which included reorganization of the regulatory structure, orderly liquidation authority in the event of future crises, limits on proprietary trading, and consumer protections. One of the most visible and ongoing elements of these reforms is the administration of annual stress tests by the Federal Reserve, known as DFAST. This process hypothesizes a range of adverse developments including economic declines, natural disasters, and other acute threats to banking stability. For the hypothesized scenarios, the impact on a bank’s financial structure is estimated, and an evaluation is made regarding whether a bank could sustain required financial strength under these circumstances. In the most recent set of tests reported this past June, all eighteen banks passed (while taking major credit losses, of course) despite facing a hypothetical scenario of 6% drop in employment, 50% drop in stock values, and 25% and 35% declines in the value of residential and commercial real estate values, respectively.

A related test conducted by the Federal Reserve is the Comprehensive Capital Analysis and Review Test, CCAR, which tests a bank’s current capital allocation plan against the DFAST scenarios. If the bank’s current capital distribution plans prevent it from maintaining required ratios, the bank can have its ability to make distributions to shareholders restricted until its capital position is strong enough to pass this test. In the most recent CCAR tests reported in June 2019, two banks of the eighteen tested proved to have unsatisfactory capital allocation plans and will be obliged to make adjustments.

The relative strength of US banks as issuers of preferred securities can be usefully contrasted with major European banks. Under European regulations, their banks’ predominant source of capital for Tier 1 (in addition to common equity and retained earnings) is Contingent Convertibles (commonly known as CoCo’s) which, unlike US preferreds, can be converted into common equity under a variety of stated conditions in which the issuer’s capital adequacy is challenged by economic conditions, adverse stock price movement, or a directive by regulatory authorities. This risk, noted by many analysts including Morgan Stanley1, is currently compounded by economic conditions which verge on recession in many areas of the Continent, particularly in export led manufacturing countries such as Germany, Italy, and the Benelux nations. This slowdown is occurring amid a fairly full corporate credit cycle that has occurred since the European financial crisis of 2011-12. Moreover, while the bank portion of total corporate credit (versus bond issuance) in Europe has declined in that period, it continues to be significantly higher than in the US, leaving European banks much more exposed to corporate risk than their American counterparts.

At Bramshill, we view the US preferred market to be an asset class that is highly differentiated from other fixed income areas as it offers 1) a variety of structures, 2) uncorrelated returns, and 3) numerous liquidity outlets to transact. For many investors, preferreds are an underutilized and underappreciated asset class which, although predominately considered equity from a capital structure standpoint, have cash flows and characteristics that more appropriately place them in fixed income allocations. As stated above, US preferreds typically are not linked to the common equity of the company but rather mimic cash flows and total returns of debt instruments depending on their seniority or subordination when issued.

Various Structures and Market Dynamics

First let us review the vast structural diversity which is available in the asset class:

- Perpetual preferreds: Long duration instruments with typically fixed coupons for life. Most structures are non-call 5yr or non-call 10yr while the coupon remains fixed.

- Perpetual fixed to floating rate: Instruments that carry fixed coupons for a short period, and at some point in the future will have a floating rate coupon that is spread over a benchmark such as LIBOR or US Treasuries. These securities usually can be called or will remain outstanding with resetting floating rate coupons every three months. This depends on their specific reset spreads, which are set at their issuance. These securities can be both short or long duration.

- High coupon/short call: Typically trading to a shorter call date and it is assumed to be called at a specific date because of an above market reset coupon. Years ago a corporate bond structure like this used to be termed as a “cushion bond” as they have a high probability of being called because of attractive refinancing rates. Trading to a short call date would usually prevent the security from reacting to significant moves in interest rates or credit spreads and as such provide a cushion of downside protection.

- $25 par vs $1000 par securities: Predominantly there are two par amount price structures with which preferreds are issued. Preferreds of $25 par structures are typically considered for the retail investor and $1000 par structures are typically placed with institutional investors. As a result of having two distinct investor bases, there can often be relative value arbitrage opportunities between these two types of preferreds.

- A variety of credit quality: Most preferreds are structurally senior to a company’s equity but subordinated to corporate debt from a capital structure standpoint. However, certain hybrid securities can be issued at various other parts of the capital structure. For example, junior subordinated hybrids trade in the preferred market and sometimes rank pari-passu with other subordinated debt. In specific sectors such as utilities, issuers may use the $25 par market to issue 1st mortgage or secured debt moving to higher quality levels of a capital structure. When debt is issued with a $25 par, these are typically called “baby bonds” and typically trade on exchanges.

A second differentiating characteristic of the US preferred market is its history of uncorrelated returns when compared to typical equity and fixed income asset classes. Using a long-term total return analysis of the US preferred market, an investor can see that preferreds act uniquely. Returns can be impacted by risk-on or risk-off environments, fluctuating timeframes of an evolving credit cycle, and shifts in credit curves as well as US Treasury interest rates. To provide two broad examples, during the 2008-2010 period, the total return of the US preferred market was impacted more by the direction and health of the various US equity markets. Price action was influenced by the selloff and subsequent recovery of the equity markets which, at the time, made sense given preferreds are issued just above the common equity part of company capital structures. The probability of corporate defaults was higher and as such, preferred’s price action “rhymed” with movement in equity valuations. In contrast, since 2013, preferred returns have had a higher correlation to moves in US interest rates and less of a correlation to the direction of US equity markets. This would make sense given the probability of corporate defaults has been lower in this time period and, with relatively fixed coupons, the preferred market has tended to be more influenced by interest rates. When managing risk in this asset class, an investor needs to balance their choices of preferred securities across these different environments while assessing potential compensation at current prices and yields.

A third unique characteristic of the preferred market is the various avenues available to transact. As previously stated, structures are typically issued in the form of $25 par for retail investors and in $1000 par form for institutional investors. We find both to be liquid, yet such liquidity varies at times due to the separate and distinct characteristics of each market. $25 par preferreds typically trade on the New York Stock Exchange. To transact, an investor can use a broker, a market maker, an OTC block desk or an algorithm. Prices can remain sticky in and around the par level due to continued retail buying and seasonality effects. $1000 preferreds which are traded over the counter and are typically traded by institutional market makers and investment banks from their high-yield trading desks or crossover desks. The $1000 preferred market is also accessible through electronic bond trading platforms such as MarketAxess where both “buy-side” and “sell-side” investors directly participate. Due to varying investor fund flows, different avenues to transact, and differentiated investor bases, there are often relative value mis-pricings within the same corporate capital structure or within a specific sector. These often lead to investment opportunities.

Conclusion

Preferred securities represent a relatively underappreciated opportunity for income-oriented investors in an overall low yield environment where attractive investments may seem hard to find. In the current market, preferred securities often offer yields and returns comparable to high yield debt, but with quality and trading characteristics more nearly approaching investment grade credits. These benefits stem largely from reforms of major bank issuers since the global financial crisis but in our view do not appear to be fully reflected in the pricing of these securities. Although these issues can be less liquid, we believe that careful individual issue selection and evaluation of sector valuation compared to other income investments can make this opportunity readily available to investors either in a multi asset portfolio or as a separate account.

Past performance may not be indicative of future results, which may be impacted by unforeseen economic events or evolving market conditions. The indices quoted are included for illustrative purposes only, as an index is not a security in which an investment can be made. Certain statements are forward-looking and may not come to pass.