Let’s play out a “What If” scenario. What if, during the next major equity bear market, bonds (and their brethren, bond funds) are NOT the negatively correlated assets that they have typically been in the past? What if passively held bond funds exhibit positive correlations to equities during a stock sell-off? It’s a great exercise and one that advisors and fixed income investors should be considering. After all, risk management is best done before the risk event actually occurs. Some investors will surely brush this off as a small probability event and therefore, will continue on with the status quo. Others, we hope, will consider the risk scenario presented above as a real risk, one that should be examined closer. We believe the experience for bond investors during the month of February 2018 should provide a good starting point.

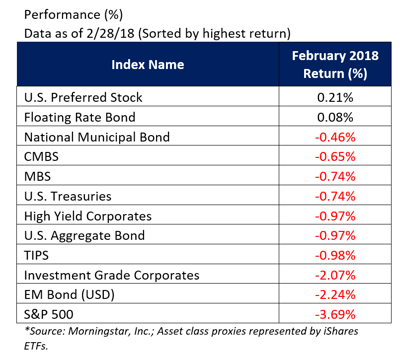

The month of February was not kind to traditional asset classes as both bonds and equities got hit. Using the iShares ETFs as rough proxies, the behemoth Aggregate Bond ETF (AGG) was down -0.97%, High Yield (HYG) was down -0.97%, Investment Grade bonds (LQD) were down -2.07%, and the riskier Emerging Market bonds (EMB) were down -2.24%. In fact, many of the fixed income ETFs were down during the month. U.S. equities, as measured by the S&P 500 TR Index, were also down, with the iShares S&P 500 (IVV) losing -3.69%. So, during the month, both stocks and bonds produced negative returns. Basically, if you were a passive investor, there were few places to hide.

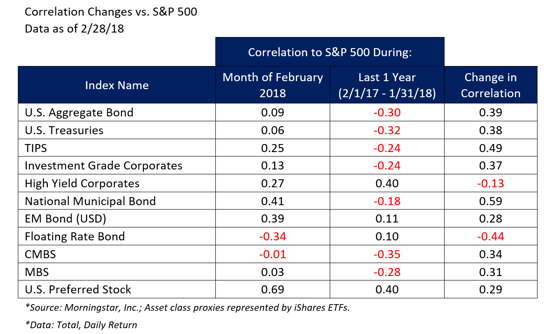

In the context of a total portfolio, the role of fixed income is arguably the most important in that it serves three primary functions – income, capital preservation and diversification. We are all aware of the challenges to produce income in the current interest rate environment and the capital preservation risks stemming from duration and credit risk. What about diversification? There has been the long standing truth that bonds provide safety during times of equity market stress. When equities zig, bonds zag. They are essential because they protect the portfolio; let you sleep at night. What if this relationship changes during the next equity market downturn? Take a look at the table below highlighting the changes in correlations relative to the S&P 500 over two time periods – the month of February 2018 and the one year prior.

The correlations changed dramatically and not in a good way.

Most of these fixed income asset classes moved from being deeply negatively correlated to being positively correlated. While the positive correlations in February are still low, the fact is, they moved in the wrong direction at the exact wrong time. It is in times of stress that bonds should maintain their diversification benefits, not start moving toward the dreaded correlation figure of +1.

These changes are eye opening and to be honest, a bit unsettling. To be fair, one month certainly does not make a trend and there are always other market factors at play. However, for fixed income investors, the combination of negative bond returns (at the same time as negative equity returns) and the move in correlations should provide a potential red flag. If the next major equity market drawdown resembles February 2018, passive bond investors will have challenges managing the drawdown risk of their total portfolio. The time for being overly passive in your fixed income allocations is at the start of the structural bull market in bonds, not at the end of it. For those advisors with an overweight to passive bond exposure, we suggest that now is the time to consider increasing your exposure to active bond managers. If fixed income becomes positively correlated to equities during the next downturn, active bond management will become more attractive as a hedge to that positive correlation risk.

As always, please reach out to the Bramshill team if you would like to discuss this further.

Did you miss our live Q4 2017 webinar?

Watch the webinar replay here.

Past performance may not be indicative of future results, which may be impacted by unforeseen economic events or evolving market conditions. The indices quoted are included for illustrative purposes only, as an index is not a security in which an investment can me made. Certain statements are forward-looking and may not come to pass.