A few months back we mentioned a major battle we felt was going to heat up in the back half of 2018. You can click here if you missed it. In sum, we felt the battle between the market forces of the policies the two men were espousing was then even-handed. We cautioned however that it was just the beginning and that “the momentum is changing. Powell’s forces are beginning to show signs of overpowering the president’s policies.”

This week marked an official start to Round 2. Weakness in autos and homebuilders from the increased cost of capital for consumer credit, and profit warnings from some major companies spilled into the overall market. The SPX index suffered a 7% drawdown from the highs earlier this month.

Trump responded with his normal off-the-cuff colloquialism and commented that the Central Bank has “gone crazy” and “the Fed is going loco.” In our opinion, the Federal Reserve is simply executing their mandate by unwinding the unprecedented monetary experiment they embarked upon ten years ago. While this creates a political problem for the POTUS as we head into midterms and counterbalances the stimulus moves he’s made over his first two years, in a way Trump is simply creating an easy scapegoat to blame for any weakness the markets may experience going forward.

Powell’s tightening cycle has kept the US Dollar well bid all year, creating a rolling drama of weakness among different economies on a monthly basis. Across emerging and developed markets overseas, Turkey, Greece, Italy, Venezuela, Thailand, Argentina, and South Africa have all experienced significant volatility. Dollar strength creates a vicious cycle in USD levered economies and as Warren Buffet once said, “Only when the tide goes out do you discover who has been swimming naked.” We expect this to continue into the foreseeable future, at least until the Fed blinks and potentially goes on hold.

Powell has been extremely clear, in our opinion, with regard to his course of action. We interpreted his recent speeches as: “We intend to methodically raise rates a quarter point each and every quarter… until we break something.”

Importantly on October 3rd, in a Q&A with PBS, Powell stated “Interest rates are still accommodative, but we're gradually moving to a place where they will be neutral," he added. "We may go past neutral, but we're a long way from neutral at this point."

The phrase “We may go past neutral,” was new news, and a real warning shot across the bow to risk assets. Given the Fed’s awful track record on modeling the business cycle, growth, as well as inflation, the markets already hold their forecasts in low regard. The statement that they are a “long way from neutral” is received with eye rolls from many players like ourselves who see the business cycle slowing in terms of rate of change here in Q4.

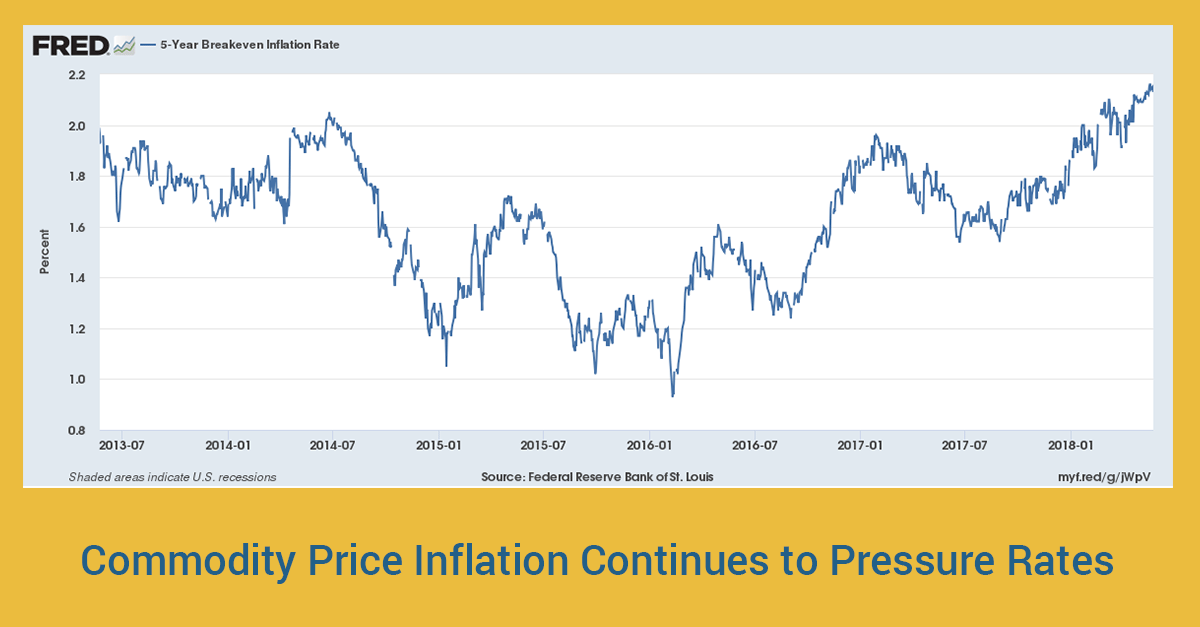

This week’s inflation data is case in point. On the inflation side, it is simply a case of base effects. In energy specifically, there was a massive increase in prices during the second half of 2017. Mathematically, it becomes extremely difficult to beat comparable headline CPI and PPI figures this year and thereby lead to markedly higher price inflation.

Interestingly however, we see wage inflation as a different story. The lack of slack in the labor market has created jump conditions for wages. Corporate board pressure to enact wage increases such as the recent Amazon announcement is mounting. Going forward, it is only on the labor side where we see accelerating inflation.

With regard to US GDP, Q318’s year on year numbers will likely be very good. Yet the Q418 numbers have very tough comparisons and the run-rate for quarterly GDP will likely slow as the calendar turns to 2019. One refrain which we believe will be repeated by many corporations, is the margin impact from the wage inflation mentioned above. Already this earnings season, Pepsi, PPG, and Fastenal have issued warnings. The commentaries from these companies were a large factor in this week’s market selloff as investors must reassess their economic assumptions. One must question how strong economic fundamentals are. To be clear, we feel the US is still a very good place relative to the rest of the world. However, we are simply moving from an amazing environment to simply a good one.

Of note, we prefer to look at year over year GDP comparisons versus quarter over quarter analysis. Typically, newspapers and financial media focus on quarter over quarter. Year on year comparisons smooth out the business cycle and simply make more intuitive sense to our investment team. Using the same quarter from the prior year for comparison sake is how to evaluate any business. Similarly, with regard to the economy, comparing spring to winter makes less sense than comparing spring to spring.

At Bramshill in 2018, one major theme underlying every portfolio decision has been that interest rates were headed higher and that this would be a disruptive catalyst to nearly every asset class. In turn, we have been well prepared for the recent events that are seemingly playing out as projected each day before us. The short duration of our portfolios, large overweight in short call, fixed-to-float preferreds with elevated resets above L+350, in addition to tactical interest rate hedging, have allowed us to significantly outperform thus far in 2018. With the rhetoric of Trump vs. Powell ratcheting to new levels this week, it’s worth noting both where this match has been and where it is headed. We see this as a bruising battle that is only beginning to enter the middle rounds.

Past performance may not be indicative of future results, which may be impacted by unforeseen economic events or evolving market conditions. The indices quoted are included for illustrative purposes only, as an index is not a security in which an investment can be made. Certain statements are forward-looking and may not come to pass.