Bramshill Investments Team

Recent Posts

2018 December Portfolio Commentary

BRAMSHILL BLOG: From the Desk of Art DeGaetano The month of December witnessed significant dislocation in risk assets. The S&P Index, the most visible risk barometer, witnessed its largest ...

Read MoreTrump Vs. Powell Update, Round 3

A few months back we updated you on a major battle we felt was going to heat up in the second half of 2018. In Round 1, back in July, we felt the battle between the market forces of the two men’s ...

Read MoreBramshill Investments Nominated for Four AltCredit Intelligence Awards

Bramshill Investments is nominated for multiple categories by AltCredit Intelligence. New York, NY (December 18, 2018) – The Income Performance Strategy from Bramshill Investments has been nominated ...

Read More2018 November Portfolio Commentary

BRAMSHILL BLOG: From the Desk of Art DeGaetano The Bramshill Income Performance Strategy produced a total return of -0.31% in November, putting our YTD returns at +2.61%. All liquid markets ...

Read More2018 October Portfolio Commentary

BRAMSHILL BLOG: From the Desk of Art DeGaetano October was a challenging month in both the fixed income and equity markets. The 30-year US Treasury yield moved +19bps higher on the month. For the ...

Read More2018 September Portfolio Commentary

BRAMSHILL BLOG: From the Desk of Art DeGaetano September was a challenging month for many fixed income markets. Meanwhile, our portfolio performed relatively well. The Bramshill Income Performance ...

Read MoreTrump Vs. Powell Update, Round 2

A few months back we mentioned a major battle we felt was going to heat up in the back half of 2018. You can click here if you missed it. In sum, we felt the battle between the market forces of the ...

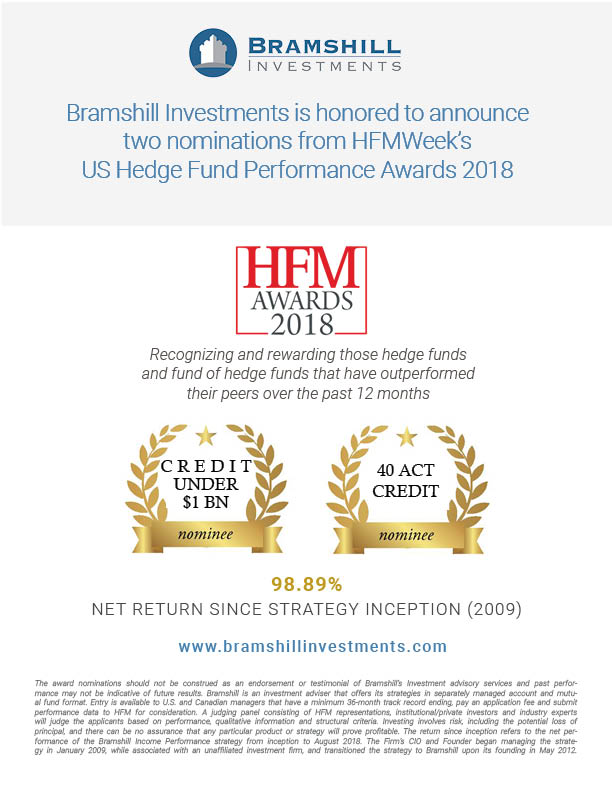

Read MoreBramshill Investments Nominated for Two Hedge Fund Awards

Alternative fixed income manager nominated second time for two hedge fund awards. Hackensack, NJ (September 27, 2018) – The Income Performance Strategy from Bramshill Investments has been nominated a ...

Read More2018 August Portfolio Commentary

BRAMSHILL BLOG: From the Desk of Art DeGaetano The Bramshill Income Performance Strategy returned +0.32% for the month of August, putting YTD returns at 3.06% (net of fees). We believe the current ...

Read MoreQ&A with Bramshill Investments: Addressing Liquidity Concerns

On our last Bramshill Investments quarterly conference call, a couple of our investors asked the following questions: Q1: Are there any liquidity concerns across fixed income today given that dealer ...

Read More