WHY NOT ALL TACTICAL BOND MANAGERS ARE CREATED EQUAL.

The more conversations we have with fixed income investors, the more we keep realizing how different we are from the crowd. While the intricacies of our day jobs differ, our goals are roughly the same - as asset allocators or as bond managers, we are both striving to produce attractive returns for our clients but most importantly, we are both seeking to avoid drawdowns. We don’t want to lose money, especially when we see elevated risks on the horizon. This turns out to be one of the core principles at Bramshill: avoid potential drawdowns when we see risk ahead of us.

Given the tactical nature of our strategy, in an environment of low interest rates and yield-seeking behavior, many investors expect our portfolio to tilt towards the riskiest sectors of the fixed income market. After all, this is where some of the highest yielding securities can be found. The expectation is that we are chasing yields and that ultimately, we will inadvertently expose their bond portfolios to unnecessary equity risk. We understand these assumptions. This is what many other tactical and nontraditional bond managers appear to be doing and the risk is certainly real. However, this is not the case with our portfolio. We don’t follow the herd. We also don’t go into the dark depths of the bond market to find yields without regard to risk. As many of our long-time readers know, our Income Performance Strategy has the ability to tactically allocate amongst five primary asset classes in which we believe offer the most attractive risk-reward opportunities at any given time: Investment Grade Corporate Bonds, High Yield Corporate Bonds, Preferreds, Municipal Bonds and U.S. Treasuries. This allows us to remain opportunistic while also remaining highly liquid.

Let’s look at two examples below to better understand the nature of the Bramshill portfolio:

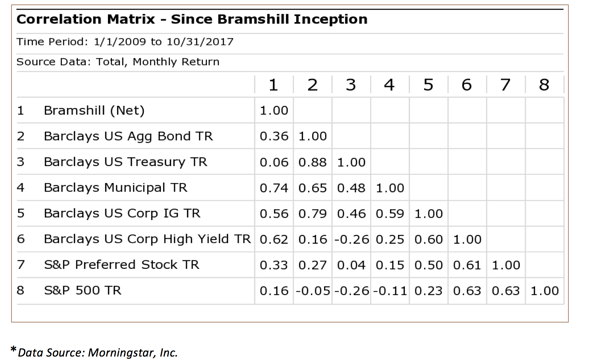

1. Looking at the since inception correlation matrix below, we see the risks are diversified. Our correlations to major equity risk - High Yield, Preferreds and S&P 500 - are quite low and in fact, offer potentially attractive diversification benefits to those sectors within the context of a total portfolio.

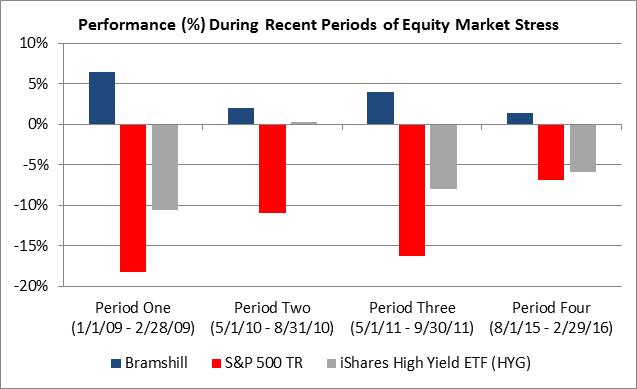

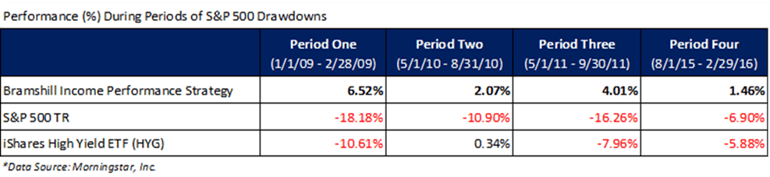

2. Considering the drawdown chart and the accompanying stats below, we see that the Strategy has performed quite well during S&P 500 sell-offs. During the most recent periods of equity market stress, Bramshill was able to produce positive returns while the experience for High Yield investors was challenging.

While we never know what the future will bring in terms of risk and reward, we do know that the team at Bramshill will continue to maintain the same investment process we’ve been running for approximately nine years. It’s one that has served our investors quite well. Given the potential for future dislocations in the credit markets, we believe now is a good time for RIAs and other fixed income investors to revisit their tactical bond managers. Understanding the unforeseen risks could be the difference between a positive return and an unnecessary drawdown.

WANT TO READ MORE BRAMSHILL MARKET INSIGHTS?

DOWNLOAD OUR QUARTERLY COMMENTARY BELOW.

Past performance may not be indicative of future results, which may be impacted by unforeseen economic events or evolving market conditions. The indices quoted are included for illustrative purposes only, as an index is not a security in which an investment can me made. Certain statements are forward-looking and may not come to pass.