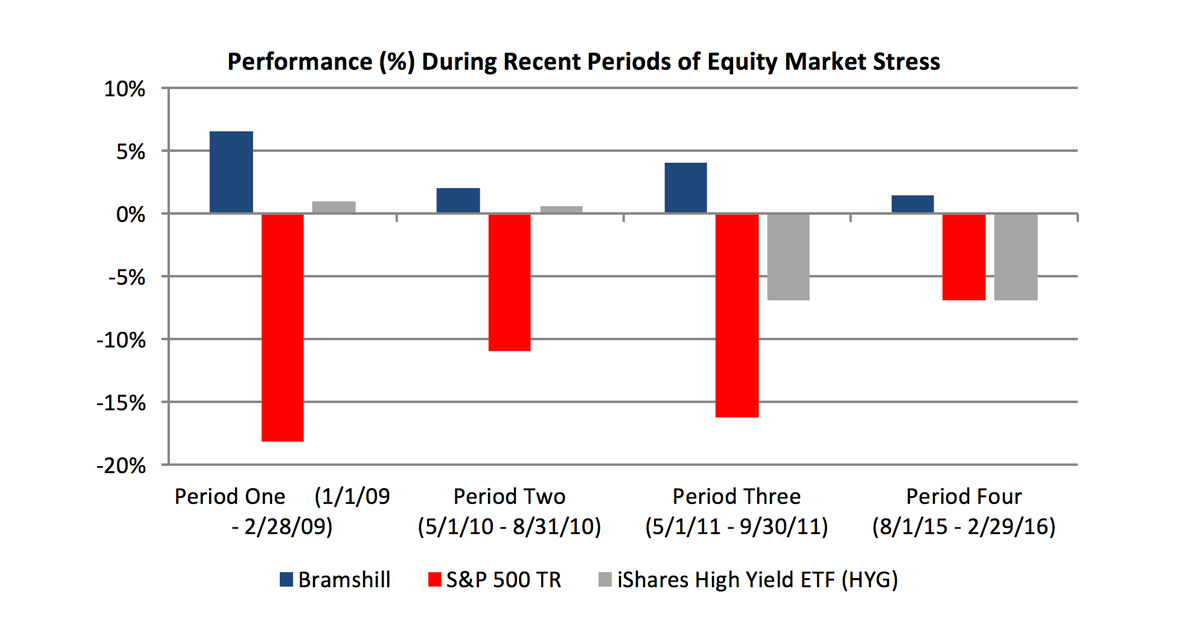

Does Your Tactical Bond Manager Avoid Equity Market Drawdowns?

WHY NOT ALL TACTICAL BOND MANAGERS ARE CREATED EQUAL. The more conversations we have with fixed income investors, the more we keep realizing how different we are from the crowd. While the intricacies ...

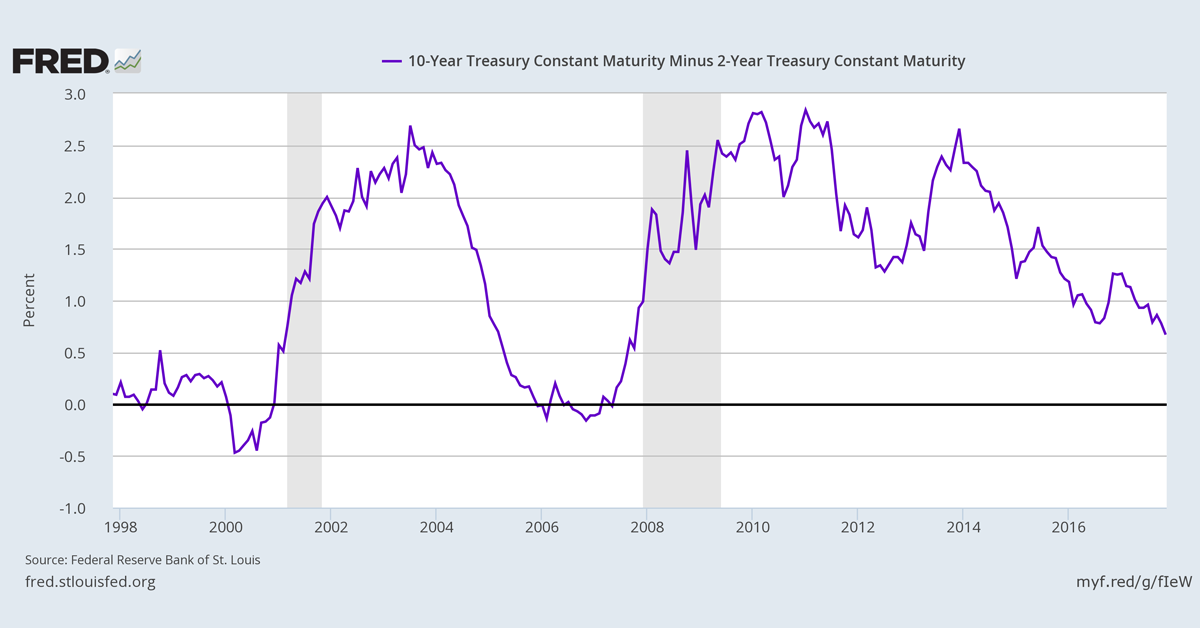

Read MoreFlattening Yield Curve: Recession Signal or False Flag? Why We’re Watching Financials

Some market participants have expressed concern about the flattening yield curve. They have noticed the flattening occurring in the U.S. Treasury yield curve and have proclaimed that a recession is ...

Read More2017 October Portfolio Commentary

BRAMSHILL BLOG: From the Desk of Art DeGaetano The Bramshill Income Performance Strategy returned -0.99% for the month of October, putting YTD returns at +1.64% net. With the backdrop of a robust ...

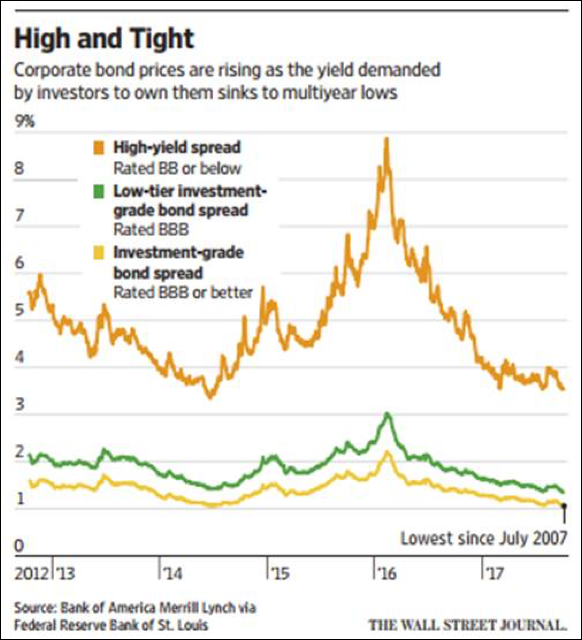

Read MoreHow Tight Credit Spreads Could Result in Higher Correlations and Increased Drawdown Risk

Fixed income investors who have made significant allocations to investment grade corporate bonds, municipal bonds, and high yield corporate debt may be surprised by negative total returns when ...

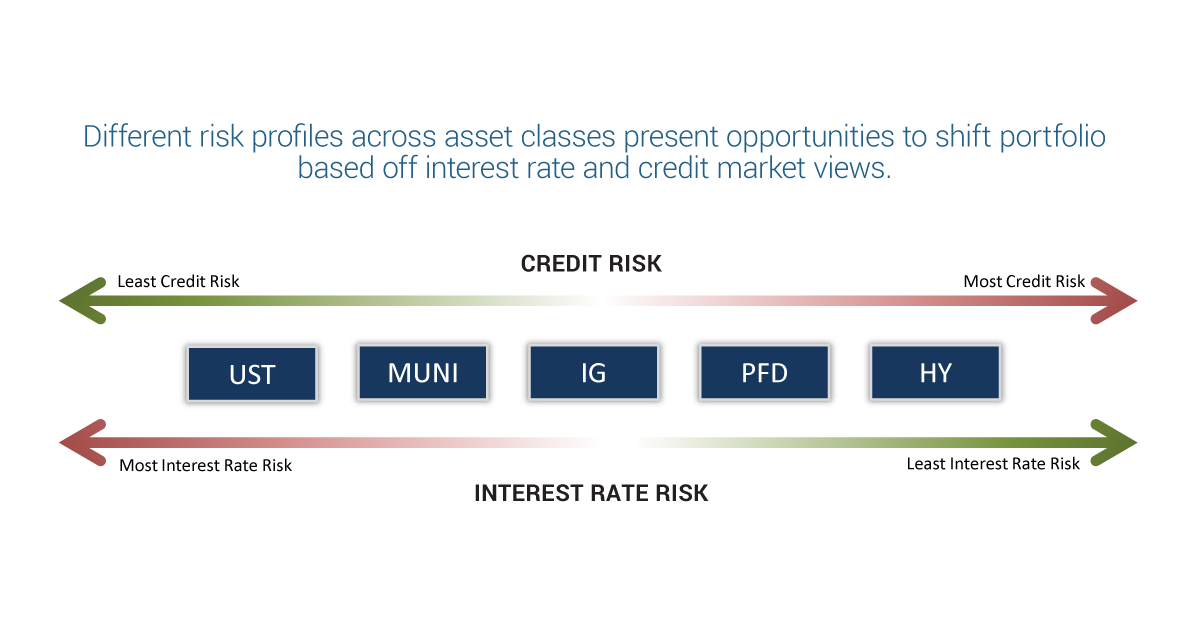

Read MoreFixed Income Asset Class Review

In preparation for our quarterly webinars with RIAs, family offices, and institutional investors, the team at Bramshill pulls together interesting market charts, macroeconomic statistics, and micro ...

Read MoreFixed Income Sector Flows During Q3 – Interesting Revelations and Few Surprises

We love analyzing sector flows within the bond market. It removes the noise of the talking heads and reveals how investors are actually allocating their fixed income portfolios. Below we review the ...

Read MoreFixed Income Perspectives: Long Only Doesn’t Necessarily Mean Only Long

Recent conversations with investors have revealed that many RIAs, family offices, and institutional investors are looking for “something different” in fixed income. It makes sense to us given that ...

Read More2017 September Portfolio Commentary

BRAMSHILL BLOG: From the Desk of Art DeGaetano While September was a challenging month for many fixed income markets, the Bramshill Income Performance Strategy performed well returning +1.77% on the ...

Read MoreOut of the Crisis Rises the Phoenix! How the Hurricanes Might Negatively Impact Your Bond Portfolio.

A lot has happened over the last few weeks. It’s almost enough to make your head spin. In an effort to understand the recent market movements and the overall impacts of the hurricanes, we’ve fielded ...

Read More2017 August Portfolio Commentary

BRAMSHILL BLOG: From the Desk of Art DeGaetano The Bramshill Income Performance Strategy returned -1.32% on the month, putting our YTD return at +0.87%. If you recall, we have repeatedly expressed ...

Read More

![2017.10-LongOnly-linkedin[1].png](https://blog.bramshillinvestments.com/hubfs/Blog/2017.10-LongOnly-linkedin%5B1%5D.png)