2018 August Portfolio Commentary

BRAMSHILL BLOG: From the Desk of Art DeGaetano The Bramshill Income Performance Strategy returned +0.32% for the month of August, putting YTD returns at 3.06% (net of fees). We believe the current ...

Read MoreQ&A with Bramshill Investments: Addressing Liquidity Concerns

On our last Bramshill Investments quarterly conference call, a couple of our investors asked the following questions: Q1: Are there any liquidity concerns across fixed income today given that dealer ...

Read More2018 July Portfolio Commentary

BRAMSHILL BLOG: From the Desk of Art DeGaetano The Bramshill Income Performance Strategy returned +0.46% net in July, contributing to a +2.72% YTD total return. In July, interest rate volatility ...

Read MoreTrump vs. Powell

One major battle we are watching closely in the second half of 2018 is the epic tug of war playing out between the economic forces of the competing actions taken by President Donald Trump and Federal ...

Read More2018 June Portfolio Commentary

BRAMSHILL BLOG: From the Desk of Art DeGaetano The Bramshill Income Performance Strategy produced a positive total return of +0.44% for the month putting our YTD returns at +2.29%. June proved to be ...

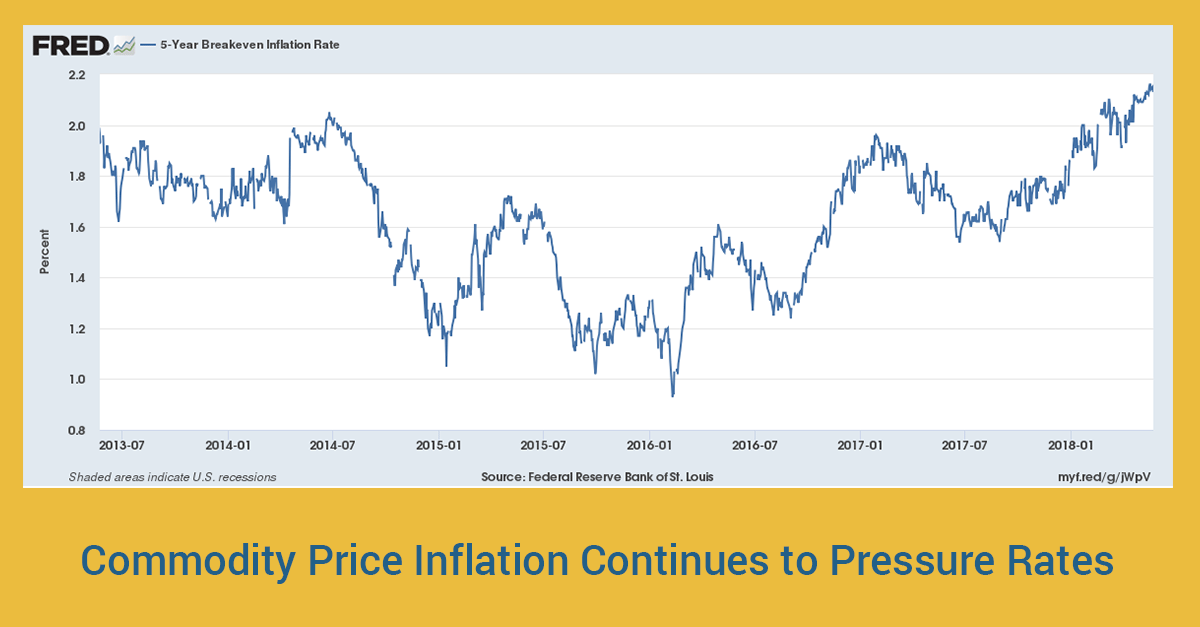

Read MoreHow will Interest Rates React to Commodity Price Inflation?

If commodity price inflation continues, how will interest rates react? We have been debating this question internally for a while now as it has meaningful consequences across asset classes. For fixed ...

Read More2018 May Portfolio Commentary

BRAMSHILL BLOG: From the Desk of Art DeGaetano Posting positive performance in fixed income, even in a rising rate environment, is something Bramshill has done consistently for many years. The ...

Read More2018 April Portfolio Commentary

BRAMSHILL BLOG: From the Desk of Art DeGaetano Bramshill showed the importance of an active approach to fixed income last month. The Income Performance Strategy performed extremely well, returning ...

Read More2018 March Portfolio Commentary

BRAMSHILL BLOG: From the Desk of Art DeGaetano The Bramshill Income Performance Strategy produced a total return of -0.21% in March putting our YTD returns at +0.01%. All liquid markets experienced ...

Read MoreThe End of TINA

Remember “TINA,” that catchy acronym standing for “there is no alternative?” It was constantly being used to justify why equities were the only logical destination for your investment dollars. After ...

Read More