As fixed income investors, we understand RIA’s need for balance between active and passive investment strategies. We also understand the need for yield. However, we believe some investors are making mistakes with regards to allocating to absolute yield at the expense of risk. Given the +30 year bull market in fixed income, risk management has not been a high priority for many bond allocators. Going forward, we believe this is likely to change as bond volatility is likely to increase as happened in the second half of 2016. Risk management is a high priority at Bramshill.

Bond investors don’t often reference standard deviation as a measure of risk. As we have discussed in our prior blogs, there are certainly more encompassing risk measures such as interest rate risk, credit risk, liquidity risk and maximum drawdown. However, one would be remiss to ignore volatility. Why? “Volatility as risk” has more to do with investor psychology.

Many bond investors have misconstrued high yields with little risk and many end-clients of RIAs seem to believe that bonds “don’t go down.” With roughly $1 trillion allocated to passive fixed income strategies, how will these investors react if bond volatility increases substantially? Will they tolerate declines in their “safest” asset class or will behavioral biases lead to poor decision-making and ultimately, sub-par fixed income returns?

Standard deviation is a widely recognized measure of volatility. The usefulness of this risk measure, however, is in assigning probabilities. Assuming returns follow a normal distribution, a foundation of Modern Portfolio Theory and the Capital Asset Pricing Model, we know that 68% of the time, future returns should fall within 1 standard deviation of the mean, and 95% of the time, we will experience returns within 2 standard deviations of the mean. This provides a useful tool in gauging the potential future experience of any asset class or security. The application of this is important in the context of an RIA’s end-client, especially for those heavily allocated to fixed income. If standard deviations were to rise substantially (they increased 2-3x’s during the 2008 crisis and 1.5-2x’s during the 2013 taper tantrum), increased volatility could easily overwhelm the income currently being offered and significantly impact total return.

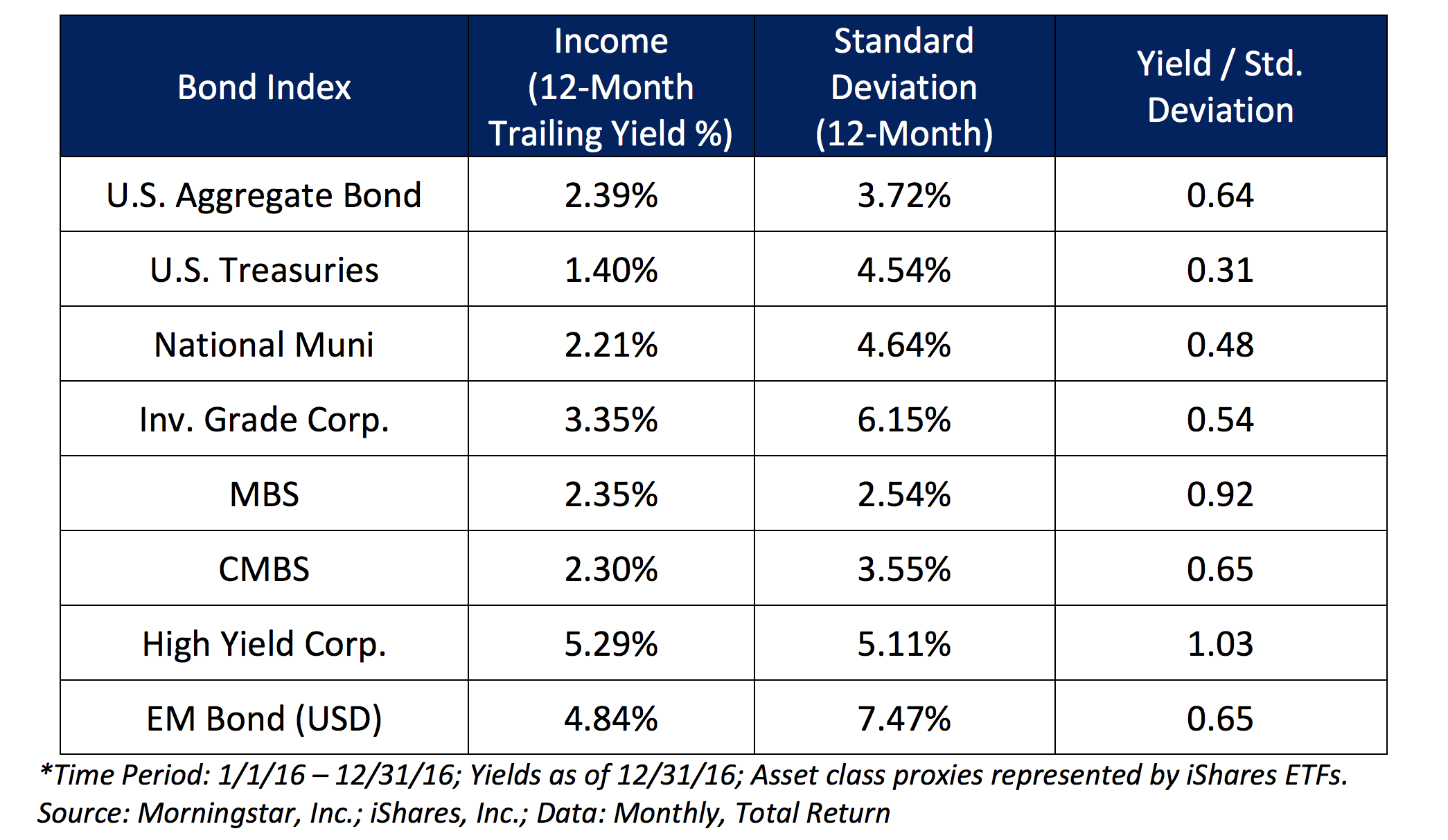

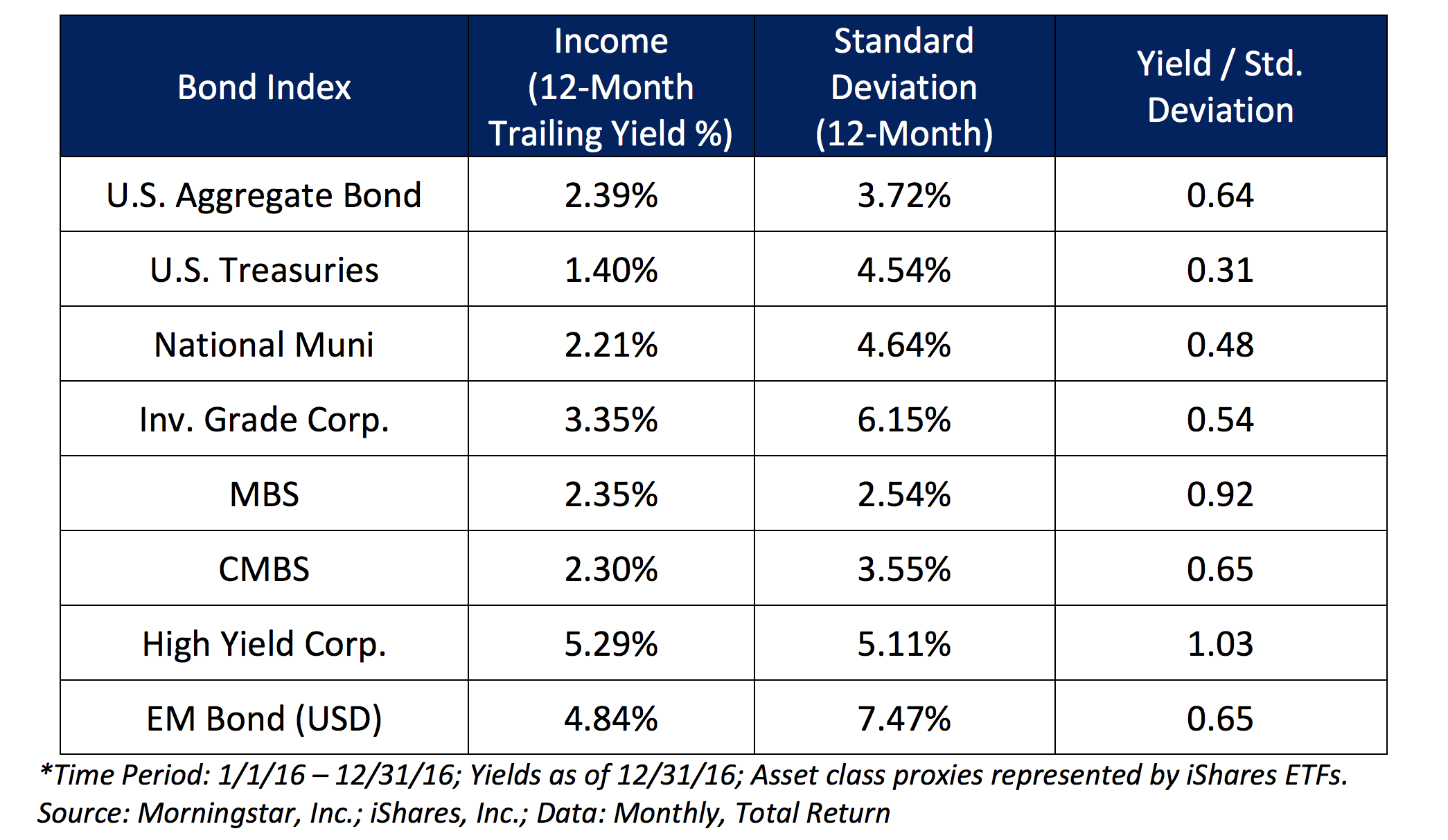

The table below highlights the risk-adjusted yields for various bond indices at different points on the volatility curve. Looking at yield relative to volatility provides an easy way to gauge the income required per unit of risk. Generally, the higher the ratio, the better risk-adjusted yield being offered by that asset class.

The above is a very simplistic analysis using only 12 months of data. It is interesting to note in the above table that volatility has been historically low in some fixed income asset classes in the last 12 months. For example, high yield has a standard deviation of approximately 10 over the last 20 years, whereas the last 12 months it has been around 5. Consider the U.S. high yield asset class returned -4.5% for all of 2015 (only one year ago), as measured by the Barclays U.S. Corp. HY TR Index (high yield ETFs lost between -5.5% to -7.2% depending on the vehicle chosen). It may be helpful for RIAs to extrapolate the above analysis over time so as to eliminate recency bias.

The table is also not meant to infer recommendations on any asset class in particular (Bramshill is in fact cautious on high yield as an asset class). As we know, there are other important risk metrics to consider before deeming an asset class attractive from a risk/return standpoint. The data does, however, provide potentially important considerations as to the quality of the yield in relation to risk tolerance. For if future volatility in the fixed income market increases, or even reverts to historical mean, standard deviation and the variance of returns could cause significant angst amongst those end-clients whose risk tolerance and expectations are misaligned. Few RIAs want to receive calls from end-clients saying, “What on earth is happening in my fixed income allocation? I’m down X%!!”

At Bramshill Investments, we manage absolute return strategies which focus on limiting downside risks while capitalizing on good risk-reward opportunities. We believe it is prudent to review your bond allocations and specifically, the yield required relative to the risk of the underlying asset class. In building portfolios for our RIA, family office and institutional investors, we embrace the philosophy that active management and tactical asset allocation in fixed income makes more sense now than it has in a very long time.

Our team would love to hear your thoughts! Please consider leaving us a comment below.

This commentary is provided by Bramshill Investments, LLC for information purposes only and may contain information that is not suitable for all investors. Certain views and opinions expressed herein are forward-looking and may not come to pass. Investing involves risk, including the potential loss of principal. Past performance may not be indicative of future results, which are subject to various market and economic factors. No statement is to be construed as an offer to sell or solicitation to buy securities or the rendering of personalized investment advice.