We talk to RIAs, wealth management firms, and institutional investors often. It’s one of the more fun parts of our jobs at Bramshill Investments. Since we consider our role as problem-solvers in fixed income, we’re always asking about the current challenges RIAs are facing with regards to portfolio construction and sharing our views on the risk reward of various asset classes and sectors in fixed income. Lately, the common concern RIAs have shared has been around constructing asset allocation models within fixed income – how to source yield while appropriately managing for interest rate risk and credit risk. (We discussed these yield/risk trade-offs in our prior blogs which can be found here and here). While we certainly agree, we wonder how much thought is being given to the sourcing of yield relative to liquidity risk.

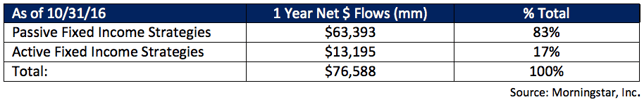

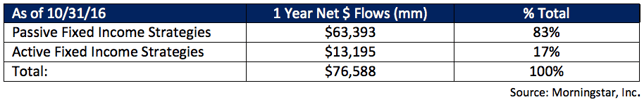

The quest for yield has been all encompassing. With yields so low, many RIAs, wealth management firms and large institutional investors have expanded their search for income into every asset class and every structure. Additionally, many RIAs have favored passive investment strategies as their chosen vehicle. In the active vs passive debate, the table below depicts bond flows over the last 1 year. As you can see, 83% of net flows have been allocated to passive investment strategies.

When markets are rallying and things are going well, many investors ignore liquidity risk. For starters, it can be difficult to analyze and difficult to quantify. The standard measures of bid/ask spreads, dealer inventory levels and trading volumes are certainly useful. Understanding what impacts liquidity – characteristics of the security, urgency of buyers/sellers and transaction size – is also helpful. This analysis can get a bit more complicated with regards to active vs passive and ETF strategies as investors need to consider primary liquidity (i.e. liquidity of the underlying securities) and secondary liquidity (i.e. “on screen” liquidity). Importantly, we believe investors should also consider current market conditions. This is important because bond market liquidity is cyclical. It is affected by monetary policy, dealer financing, investors’ risk appetites, issuance cycles, etc.

When markets are rallying and things are going well, many investors ignore liquidity risk. For starters, it can be difficult to analyze and difficult to quantify. The standard measures of bid/ask spreads, dealer inventory levels and trading volumes are certainly useful. Understanding what impacts liquidity – characteristics of the security, urgency of buyers/sellers and transaction size – is also helpful. This analysis can get a bit more complicated with regards to active vs passive and ETF strategies as investors need to consider primary liquidity (i.e. liquidity of the underlying securities) and secondary liquidity (i.e. “on screen” liquidity). Importantly, we believe investors should also consider current market conditions. This is important because bond market liquidity is cyclical. It is affected by monetary policy, dealer financing, investors’ risk appetites, issuance cycles, etc.

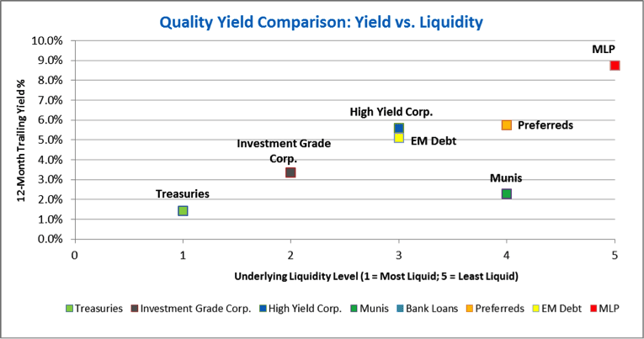

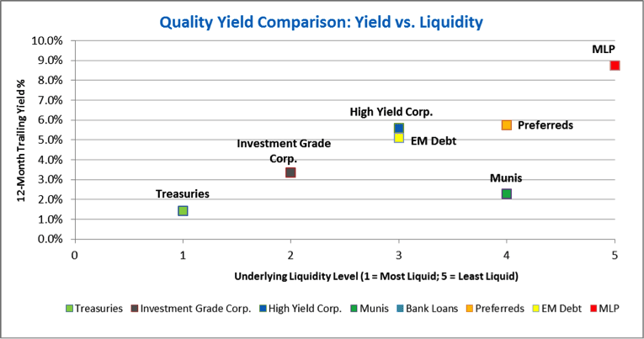

In closing, we would like to remind advisors that liquidity is not free. There is a cost associated and that cost can be extreme when market conditions get difficult. Given the tightening liquidity conditions we observe in the marketplace, we believe RIAs would be prudent to reevaluate their passive investment allocations in fixed income with regards to liquidity. The chart below depicts various passive investment strategies in fixed income based on their yield relative to the liquidity of their underlying securities. This is a very basic depiction but given RIAs' all-encompassing search for yield, we have seen billions of dollars allocated to such vehicles. Risk management in core fixed income is, in our opinion, becoming a critical component of an RIA’s due diligence and portfolio construction.

Source: Morningstar, Inc.; iShares.com; Bramshill Investments

Source: Morningstar, Inc.; iShares.com; Bramshill Investments

Our team would love to hear your thoughts! Please consider leaving us a comment below.

When markets are rallying and things are going well, many investors ignore liquidity risk. For starters, it can be difficult to analyze and difficult to quantify. The standard measures of bid/ask spreads, dealer inventory levels and trading volumes are certainly useful. Understanding what impacts liquidity – characteristics of the security, urgency of buyers/sellers and transaction size – is also helpful. This analysis can get a bit more complicated with regards to active vs passive and ETF strategies as investors need to consider primary liquidity (i.e. liquidity of the underlying securities) and secondary liquidity (i.e. “on screen” liquidity). Importantly, we believe investors should also consider current market conditions. This is important because bond market liquidity is cyclical. It is affected by monetary policy, dealer financing, investors’ risk appetites, issuance cycles, etc.

When markets are rallying and things are going well, many investors ignore liquidity risk. For starters, it can be difficult to analyze and difficult to quantify. The standard measures of bid/ask spreads, dealer inventory levels and trading volumes are certainly useful. Understanding what impacts liquidity – characteristics of the security, urgency of buyers/sellers and transaction size – is also helpful. This analysis can get a bit more complicated with regards to active vs passive and ETF strategies as investors need to consider primary liquidity (i.e. liquidity of the underlying securities) and secondary liquidity (i.e. “on screen” liquidity). Importantly, we believe investors should also consider current market conditions. This is important because bond market liquidity is cyclical. It is affected by monetary policy, dealer financing, investors’ risk appetites, issuance cycles, etc.