How quality is your yield? Will that yield be protected from the risks lurking in today’s fixed income market? These are just some of the questions and challenges facing RIAs and investors globally. At Bramshill Investments, we manage absolute return solutions in fixed income and income producing assets with a focus on five distinct asset classes (investment grade and high-yield bonds, preferreds, municipal bonds, and U.S. Treasuries). We understand the challenges RIAs are facing in their search for yield; as portfolio managers, we are facing them as well. Hopefully, you will find our cautionary considerations related to credit risk useful as you re-evaluate your fixed income allocations.

Lately, credit risk seems to be irrelevant to RIAs and investors. Macro influences, courtesy of the central banks, have created an environment of complacency - especially when it comes to credit quality. The passive investor doesn’t appear to care about good or bad fundamentals…they own everything. Actively managed bond mutual funds have routinely allocated to the riskiest securities in an all-out scramble to beef up their advertised yield with hopes of attracting inflows from yield-starved investors. Together, the flows into yield-enhancing strategies have been massive. However, with complacency, comes risk.

A few things to consider…

- As companies issue debt, is the rationale behind the issuance the “right” reason?

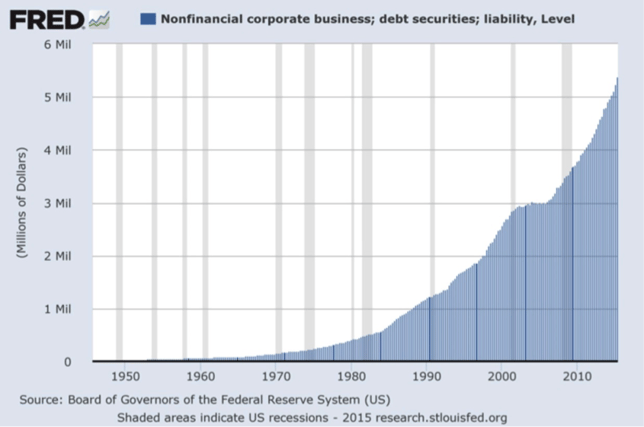

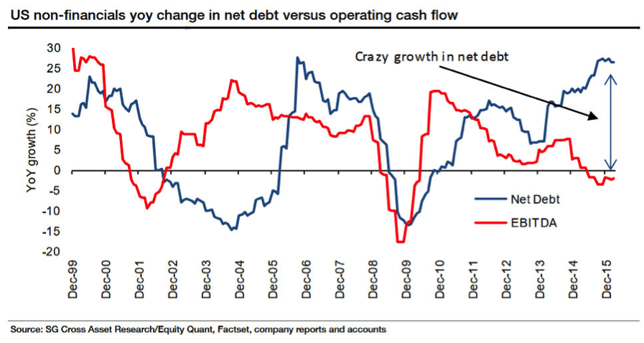

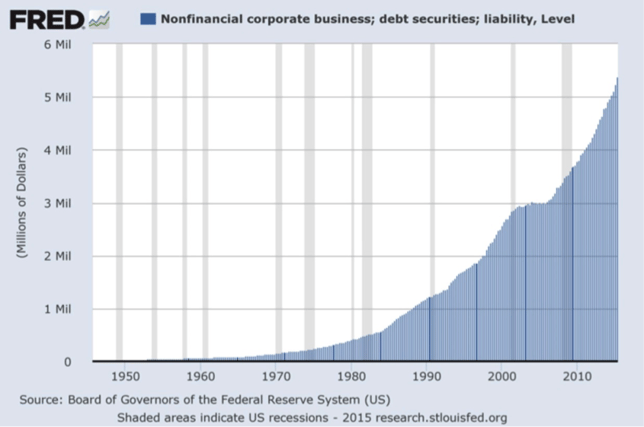

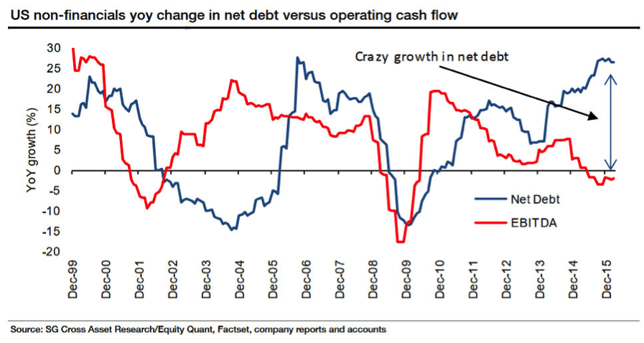

- Since 2009, U.S. corporations have issued almost $3 trillion in debt (roughly equal to the debt issuance of the last 50 years)…much of this went to buybacks, dividends and M&A.

- While this is good for equity investors, it is NOT good for bond investors who would much rather see the capital being used for long-term productive purposes not as a short-term reward for equity holders.

- Are we at the late stages of the economic cycle?

- Economic downturns and equity market sell-offs often coincide with increased default rates, and as investors know, high yield and speculative grade securities tend to be more highly correlated with equity prices than higher quality bonds.

- Taking undue credit risk in attempt to capture enhanced yield could lead to increased drawdowns and an unexpected loss of capital as we move through the economic cycle.

- Where are we in the debt cycle?

- Debt cycles (and especially the debt super-cycle of the last 30+ years) tend to mask credit risk. Currently, per S&P Ratings, the average credit rating of U.S. corporations is BB - … yes, this means that the average U.S. corporation is a highly speculative investment.

- With corporate revenues weak and interest coverage ratios declining, default risk appears to be increasing in a meaningful way.

To be clear, we are not advising investors to completely avoid credit risk. Instead, we are recommending caution…don’t overweight yield relative to risk. Invest for value. Sometimes this means forgoing that attractive advertised yield for a higher quality total return. Protecting capital and ultimately protecting future income is becoming paramount, and at some point, credit analysis will matter again as investors will be rewarded for differentiating between credit fundamentals.

The team would love to hear your thoughts! Please consider leaving us a comment below.