RIAs, financial advisors or asset allocators have an incredibly difficult job in today’s environment. For RIAs, the objective of meeting your client’s return requirements given their risk tolerance has always been a blend of art and science. Typically, the “easiest” part was the asset allocation to fixed income. Rarely did one have to consider credit risk, interest rate risk or liquidity risk with much concern. Passive investment strategies were often “no-brainers” – access the entire market at the lowest cost. Set it, forget it and review next year. As we look forward, however, the landscape is changing. Risk management in fixed income is becoming a critical component of an RIA’s asset allocation. As the challenges of low interest rates persist, many investors have expanded their search for yield further and further out the risk curve. We believe this is a mistake. The team at Bramshill Investments is proceeding with caution, and we’d like to share our market insights for your consideration related to risk, specifically, the risk of capital loss.

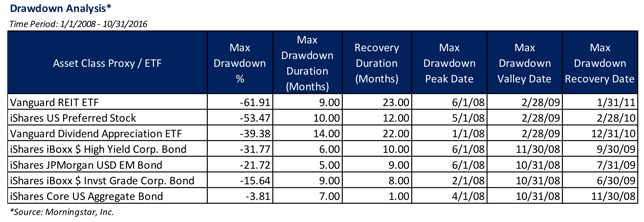

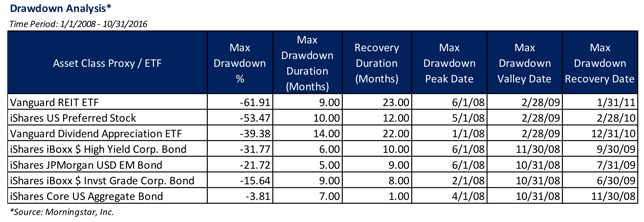

Absolute yield is NOT enough to compensate for downside risk. Since fixed income investors are not accustomed to taking losses, we believe investors should consider how much interest income is required relative to the downside risk being taken. Maximum drawdown is a useful metric to gauge the potential for capital loss. We all know that the litmus test for downside risk is the 2008/09 financial crisis. As we can see in the table below, the peak to trough losses can be deep. With regards to max drawdown, there are a few important measurements to consider: 1. Depth of the drawdown (i.e. the absolute loss incurred peak to trough); 2. Duration of the drawdown (i.e. over how many months was the decline); 3. Duration of the recovery (i.e. how quickly were the losses recouped). In general, the riskier parts of the yield-searching universe suffered the deepest losses and took the longest to recapture those losses.

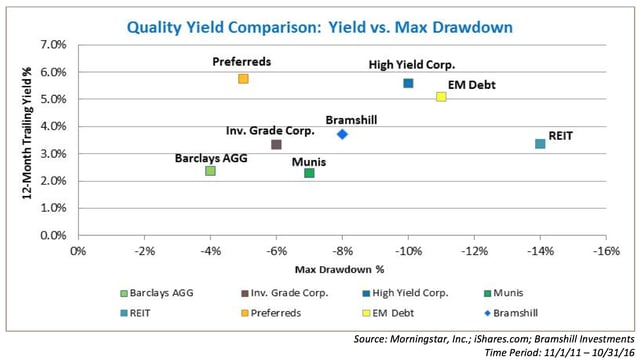

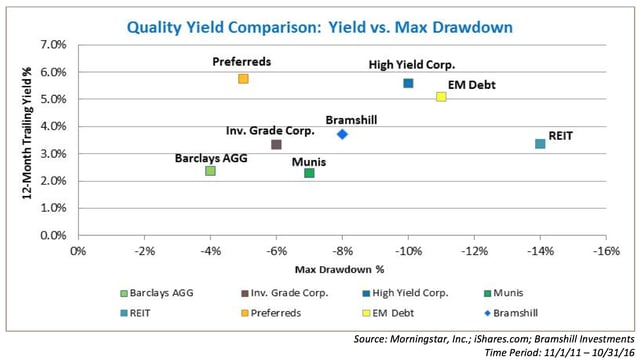

While we are certainly not forecasting another 2008/09 financial crisis, we are proceeding with caution and we believe tactical asset allocation and active management in fixed income may help to mitigate risk while providing opportunities to harness return. With interest rate risk and political risk on the rise, as well as an economic cycle that is quite extended, there is potential for increased volatility going forward. Naturally, there will be times when certain sectors of the fixed income market will experience downside pricing pressures. Our hope is that RIAs and their clients will reevaluate their fixed income allocations and are comfortable with the potential downside risk. The chart below plots the current twelve-month trailing distribution yields relative to the maximum drawdown that has occurred over the last five years. The asset classes below are represented via the iShares ETFs and are used solely as a proxy for estimating the downside risks of potential asset classes. In no way is this meant to be an exhaustive analysis. Rather, we hope it can be used by RIAs, financial advisors in meetings with clients as you discuss the risk reward options in fixed income for 2017.

Our team would love to hear your thoughts! Please consider leaving us a comment below.