Fixed income investors who have made significant allocations to investment grade corporate bonds, municipal bonds, and high yield corporate debt may be surprised by negative total returns when interest rates move higher even though the economic environment and corporate earnings continue to improve. The culprit will be tight credit spreads. With U.S. Treasury yields so low, and spreads so tight, these asset classes have a high probability of being extremely correlated, especially if interest rates move markedly higher.

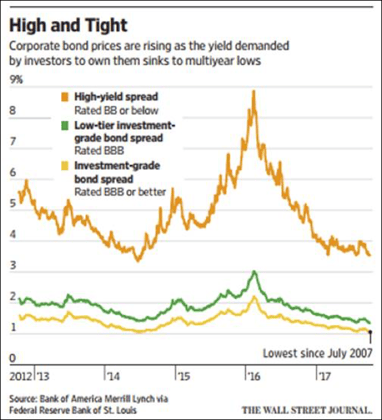

Many fixed income asset classes are priced in spread over the risk-free rate. Spreads typically reflect how much return investors are willing to accept based on the creditworthiness of an underlying borrower. At this time, the spreads of investment grade corporate bonds, municipal bonds, and high yield corporate debt remain at extremely low levels as investors are willing to accept very little incremental yield over Treasuries. This condition has occurred in the past. However, in our opinion, the difference today is that absolute yields are extremely low and do not compensate investors for the risks that they are incurring. After all, with yields so low, it does not take much for prices to decline before the negative price action overwhelms the paltry yield currently offered in the marketplace, thereby resulting in a negative total return.

Our recommendation for RIAs and other bond investors is the following: over the past 8+ years, interest rates have not played a significant role in your allocations or portfolio positioning. Going forward, a view on rates may be necessary and may play a larger role in your fixed income allocation decisions. Passive, index-like products will need to be complemented with active bond managers who have a demonstrated ability to protect against drawdowns in a rising rate environment.

This commentary is provided by Bramshill Investments, LLC for informational purposes only and may contain information that is not suitable for all investors. Certain views and opinions expressed herein are forward-looking and may not come to pass. Investing involves risk, including the potential loss of principal. Past performance may not be indicative of future results, which are subject to various market and economic factors. No statement is to be construed as an offer to sell or a solicitation of an offer to buy securities, or the rendering of personalized investment advice.