On our last Bramshill Investments quarterly conference call, an investor asked:

Q: How do you define overweight preferreds? Relative to what? What’s normal?

A: Art DeGaetano: In the eight-year track record, there have been three major shifts. The first one was munis when we were buying AA Cornell bonds at 7%, and the high yield index was trading at 7.50 with CCCs. We were about 70% muni, so we had large concentrations. Everything we do has stop losses, it’s not done in a cavalier way. It’s a very thought-out risk-reward method that we run our processes.

A: Art DeGaetano: In the eight-year track record, there have been three major shifts. The first one was munis when we were buying AA Cornell bonds at 7%, and the high yield index was trading at 7.50 with CCCs. We were about 70% muni, so we had large concentrations. Everything we do has stop losses, it’s not done in a cavalier way. It’s a very thought-out risk-reward method that we run our processes.

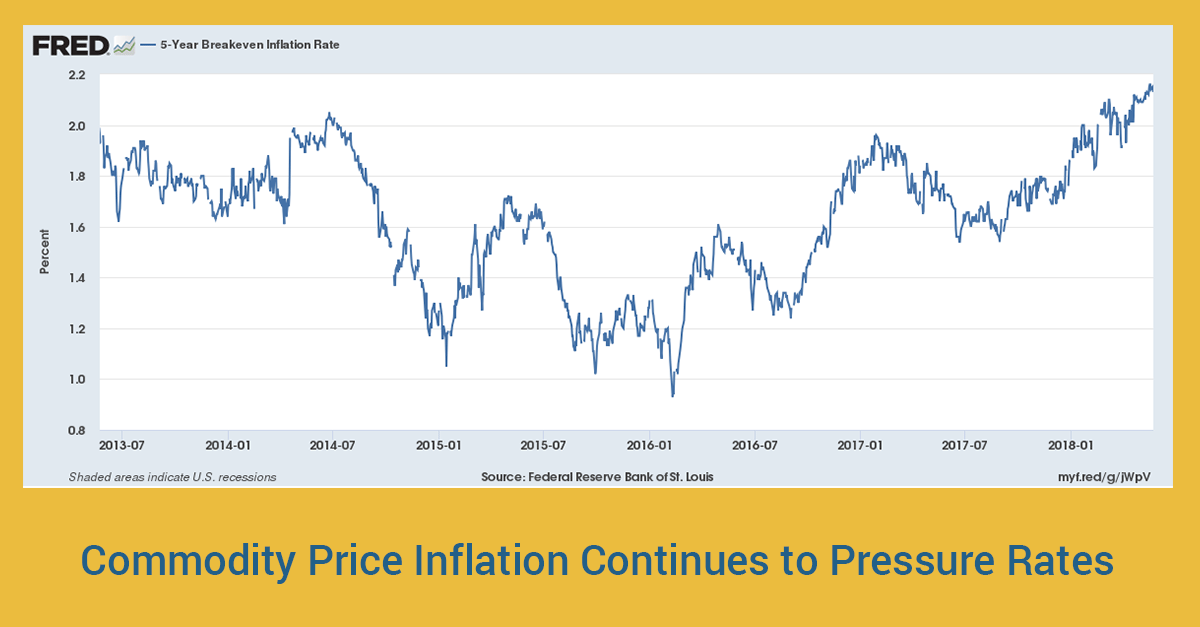

Post the taper tantrum, the preferred allocation coming into ’14 about 62% was our high allocation. Now, put it in context. Wells Fargo preferreds were trading around 6.50 and high yield index was at 5%. Dodd Frank is causing people to take less risk, so Wells Fargo, when we did our analysis, and we were a little more favorable in rates with a 3% ten-year warranted a significant position. In coming into ’16, and the first quarter, second quarter of ’16, we were about 45% in credit. Credit really backed up, some high yield, mostly DD, BBB, some floating rate.

We don’t have a benchmark for overweight. I believe it’s where our higher concentration is in the position. Then, we’re constantly scenario-analyzing and basically saying what risk reward and probability do we have to lose money here? That warrants how much we will go in an allocation. For example, last March, we bought Apple bid [ph] at $0.82 on the dollar. We thought there was no way it was going to default. With things like that, they warrant more significant allocations. With preferreds, we’re probably about 60-55% of where we would think of a full allocation, given the risk reward. There’s decent value, but we’re not expressing it with long duration. We’re expressing it with a blend, just because we’re defensive on rates.

A month ago, we were, with 260 on a ten-year and David Tepper saying everyone should short them. We were a bit constructive; we took more duration. So, we don’t have a specific target, but it’s more relative to the portfolio and how big you want to have an allocation. So, we’re overweight preferreds versus the other assets classes, but we still have about a third of the portfolio in very defensive, cash-like, currently callable in things that won’t move, so we could go up significantly further if we saw a very good investment there.

Please feel free to contact the team with any questions or comments.

This commentary is provided by Bramshill Investments, LLC for information purposes only and may contain information that is not suitable for all investors. Certain views and opinions expressed herein are forward-looking and may not come to pass. Investing involves risk, including the potential loss of principal. Past performance may not be indicative of future results, which are subject to various market and economic factors. No statement is to be construed as an offer to sell or solicitation to buy securities or the rendering of personalized investment advice. Bramshill does not provide investment advice with respect to individual holdings or portfolios outside of the assets and accounts for which the Firm has been engaged to manage.

A:

A: