The debate on active vs passive management has never been this hot. Lately, everywhere you turn someone is writing about the net flows and growth of passive investing. The Wall Street Journal launched a whole series on the topic entitled, “The Passivists.” At Bramshill Investments, we are an active manager focused on absolute return solutions in fixed income and income producing assets. We tactically allocate between five distinct asset classes (investment grade and high-yield bonds, preferreds, municipal bonds, and U.S. Treasuries), so not only are we living in the category of “active managers” we also fall into the “tactical” bucket within that group.

That said, we share the views of our colleague Michael Roberge co-CEO, CIO and president of MFS Investment Management who recently opined that perhaps the investor who utilizes both active and passive strategies in client portfolios is actually the winner. His article, Active vs Passive: Choose Both, recently appeared in the Wall Street Journal.

That said, we share the views of our colleague Michael Roberge co-CEO, CIO and president of MFS Investment Management who recently opined that perhaps the investor who utilizes both active and passive strategies in client portfolios is actually the winner. His article, Active vs Passive: Choose Both, recently appeared in the Wall Street Journal.

In our opinion, passive investing works great – until it doesn’t. If all investors convert to “do nothing investors” hoping to ride the market up, they will also ride the market down, along with every ounce of volatility in between. A skilled active manager has the potential to help mitigate some downside risk. As Roberge states in the article, "Active managers … have outperformed in volatile market environments. Between 1990 and 2014, the top quarter of active managers generated 7.6% in excess returns in falling market environments."

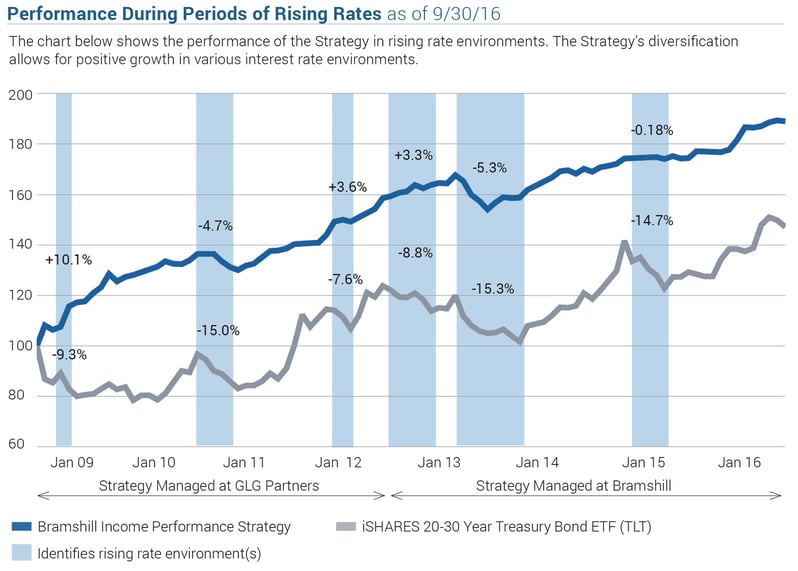

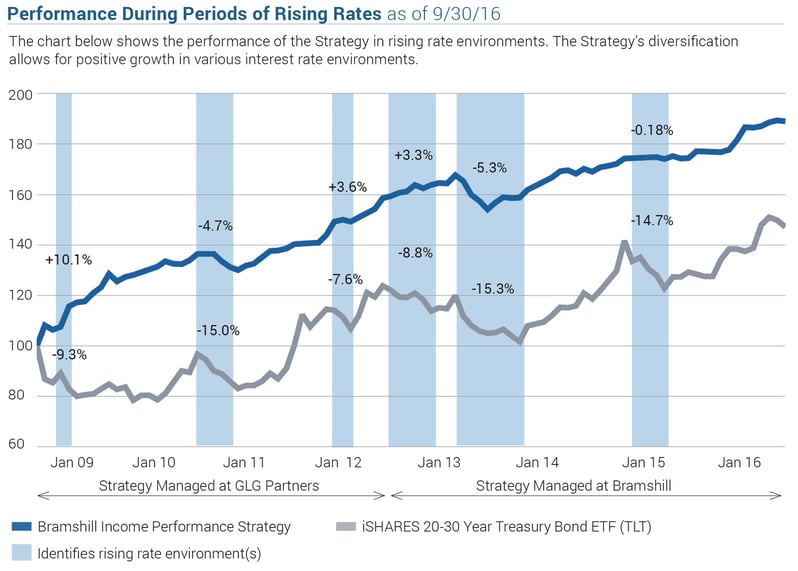

As fixed income investors, there have been few opportunities to illustrate our ability to navigate challenging markets, but there have been at least 6 periods of rising interest rates since Bramshill’s inception with another beginning this September. Passive investors in the popular TLT index were swiftly impacted by the rate backups while Bramshill, an active manager, was able to navigate these challenges well. Below is a chart illustrating the Bramshill Income Performance Strategy’s performance in rising rate environments as compared to the TLT ETF.

It is important to note that due to all of the Fed stimulus (the Fed’s balance sheet has grown to over $4 trillion) since the bottoming of the financial crisis in March ’09. Bond yields have moved progressively lower over time creating a benevolent time for investors. Both bond prices and risk assets have paradoxically rallied together over the past 7 years – clearly due to unprecedented Fed monetary stimulus. Passive fixed income investing has produced consistent modestly positive returns. However, if this stimulus ends, as expected, active tactical strategies will likely outperform.

To quote Roberge, “How do you distinguish between skilled and average? It really comes down to conviction and risk management. Simply put, managers who are willing to make significant investments beyond the index that serves as their benchmark-commonly referred to as active share-and hold those investments for long time periods have outperformed over time."

Investors need to build a diversified portfolio for their clients and passive investments may certainly have a valuable role, but we believe that true active management has a role as well. Our firm is built on the premise that the Bramshill team can help our investors navigate the challenges in fixed income while taking advantage of the opportunities. It’s a mission that drives us every day.

Missed our intro conference call? Listen to the replay!

Stephen Selver is the CEO at Bramshill Investments, an asset management firm specializing in absolute return solutions within fixed income and income producing assets. Click here to view his bio and other team members of Bramshill Investments.

Stephen Selver is the CEO at Bramshill Investments, an asset management firm specializing in absolute return solutions within fixed income and income producing assets. Click here to view his bio and other team members of Bramshill Investments.

That said, we share the views of our colleague Michael Roberge co-CEO, CIO and president of MFS Investment Management who recently opined that perhaps the investor who utilizes both active and passive strategies in client portfolios is actually the winner. His article,

That said, we share the views of our colleague Michael Roberge co-CEO, CIO and president of MFS Investment Management who recently opined that perhaps the investor who utilizes both active and passive strategies in client portfolios is actually the winner. His article,