The team at Bramshill has been fielding numerous questions about passive investing within fixed income. While we briefly discussed this topic during our most recent conference call in late April, we thought it would be helpful to RIAs and other bond investors if we expanded upon that conversation.

First, let’s get the obvious out of the way. We are active fixed income managers, and therefore, we are biased in our views regarding the active/passive debate. However, as asset allocators, we see the merits of utilizing both types of strategies and believe that in the context of a full portfolio, there is a case to be made for a blended approach. Secondarily, while passive bond investing has garnered plenty of attention, the reality is that the traditional bond space is still dominated by active management; of the taxable bond mutual funds and ETFs out there, roughly 71% of total assets are allocated to active managers (according to Morningstar, Inc. data as of 4/30/17).

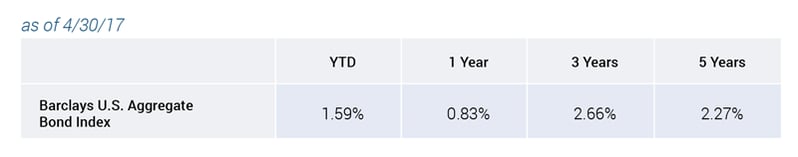

We know, however, that passive bond strategies are attracting a significant amount of assets. The data doesn’t lie. Passive bond strategies have attracted approximately $172 billion, roughly 64% of all net flows. And we recognize there is a place in a portfolio for a passive allocation. However, this trend strikes us as a “crowded” trade which could likely result in continuous low returns in fixed income. Consider the returns of the past five years in Bloomberg Barclays Aggregate Bond Index which seem marginal at best:

The trend to passive bond investing is certainly alive and well. Just to reiterate, we are not against passive. Provided the market environment is appropriate, an overweight to passive bond strategies makes sense. This is not, however, the environment for a 100% passive fixed income allocation or even a significantly overweight passive portfolio. That would have been more appropriate at the start of the bond bull market, not near the end.

As an example of passive bond investors taking too much risk for far less return, let’s consider the iShares Core U.S. Aggregate Bond ETF (AGG):

- AUM = approximately $44 billion allocated to this “safe” bond index.

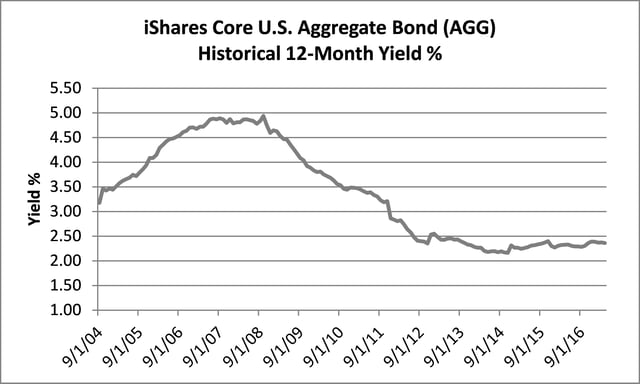

- Yield = hovering around all-time lows (12-month yield = 2.36% as of 4/30/17).

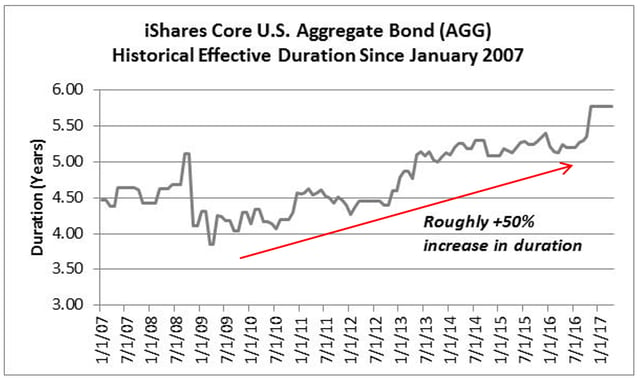

- Duration = interest rate risk has increased significantly, up roughly 50% since March 2009.

Less Return: Yields Hovering Near All-Time Lows

*Source Data: Morningstar, Inc

More Risk: Interest Rate Risk (Duration) has Increased +50% Since March 2009

*Source Data: Morningstar, Inc

So, what does it all mean for passive investors in fixed income? From our perspective, it means RIAs and other bond investors are taking on significantly more risk for far less yield. By allocating to passive bond strategies, you are basically locking in low rates and giving up any chance for additional yield or alpha. You’re also essentially taking a fixed duration implying that one is content with a duration of roughly six years for the AGG. Fixed duration in an environment of potentially rising rates is a tough spot to be in. Lastly, there is still credit risk to be concerned with. Passive fixed income ETFs are weighted by debt issuance, meaning you are buying the largest issuers of debt. This is exactly the opposite of how credit analysts would make financing decisions; far better to buy those issuers with the greatest ability to service their debt, not the ones with greatest appetite. One does not want to overweight the most debt-burdened issuers because when things turn, credit risk will become important again. If/when downside price risk emerges, not all investors will be able to exit passive strategies at the same time. Losses will be incurred.

Our advice to RIAs and other fixed income investors: Consider diversifying some of your passive bond exposure into high quality active managers. At this time, the risk/reward dynamic favors active over passive. For allocators looking for active managers, we recommend those that can provide high quality yield/total return while offering downside protection and attractive correlation benefits to your passive bond investments. The time is right. We hope you consider Bramshill Investments as you search for the proper fit.

Please contact the team at Bramshill if you would like to discuss further. Thank you.

Stephen Selver is the CEO at Bramshill Investments, an asset management firm specializing in absolute return solutions within fixed income and income producing assets. Click here to view his bio and other team members of Bramshill Investments.

Stephen Selver is the CEO at Bramshill Investments, an asset management firm specializing in absolute return solutions within fixed income and income producing assets. Click here to view his bio and other team members of Bramshill Investments.

Past performance may not be indicative of future results, which may be impacted by unforeseen economic events or evolving market conditions. The indices quoted are included for illustrative purposes only, as an index is not a security in which an investment can me made. Certain statements are forward-looking and may not come to pass.